Understanding the Wealth Gap and What It Means for You

The numbers in the charts below are hard to ignore. The gap in assets and liabilities between the top 1%, those in the middle, and the bottom 50% of U.S. households isn’t just surprising — it tells a story. But before we get into it, I want to be clear:

This blog is not about how to fix wealth inequality.

If I had a plan to solve it, I’d be shouting it from every rooftop. What I can offer instead is perspective—and a path forward for you and your family.

The Wealth Breakdown: A Look at the Charts

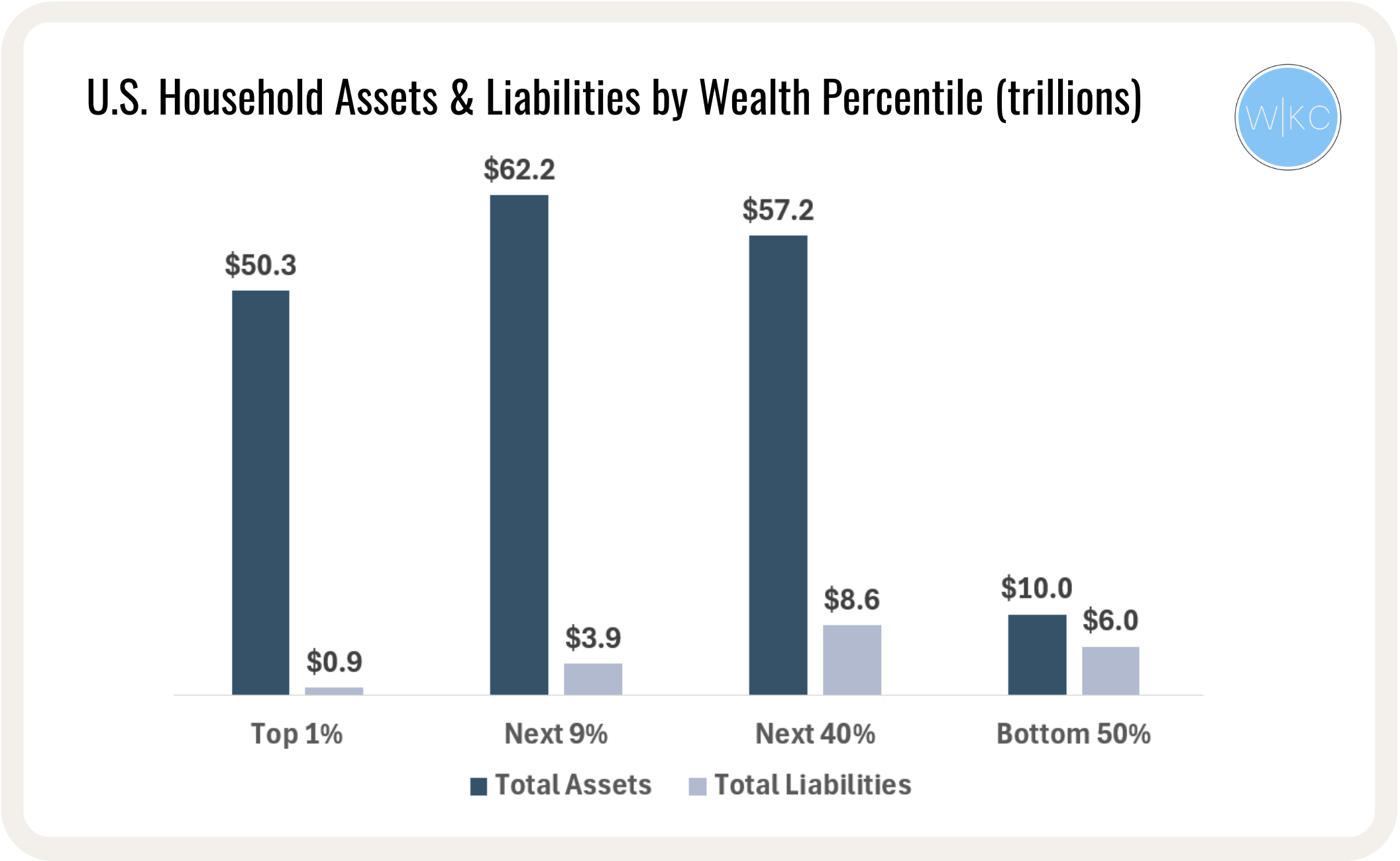

From the Federal Reserve's data as of 12/31/2024, we see:

The Top 1% controls over $50 trillion in assets and just $0.9 trillion in liabilities.

The Bottom 50%? Roughly $10 trillion in assets, weighed down by $6 trillion in liabilities.

The Next 40% carries $8.6 trillion in liabilities, the largest share of household debt.

Another way to look at it:

The Next 40% holds 31.8% of all U.S. assets but 44.5% of all liabilities.

The Bottom 50% owns only 5.6% of assets, yet shoulders 30.9% of liabilities.

So, what’s the main point?

While the numbers make the inequalities pretty clear, it’s important to recognize that a lot of what we’re seeing stems from deep, systemic issues — things like generational wealth gaps, unequal access to education, and wage stagnation. These are real, complex challenges that deserve real attention.

But if you’re reading this, chances are you’re someone who likes to focus on what you can control — and how to make smart, intentional moves that actually move the needle. That’s where habits come in.

One of the most powerful financial habits?

Understanding and taking advantage of compounding. The wealthiest households don’t just save — they invest in ways that allow their money to grow and then grow on itself. It’s like a snowball rolling downhill—the longer it rolls, the bigger and faster it grows. You don’t need to pick the perfect stock or time the market. You just need to start. Every dollar you invest is a little seed — and when you’re consistent, those seeds can grow into something meaningful. Not just for you, but for future generations.

On the flip side, debt is often the quiet killer of financial progress. The data shows that liabilities weigh heavily on the bottom half of U.S. households — and many of those debts are avoidable. Overspending on homes, cars, or lifestyle can create a drag that makes it nearly impossible to get compounding working in your favor.

That $80,000 SUV might look great in the driveway, but it’s not building your net worth.

Stretching for a bigger mortgage doesn’t speed up equity — it shrinks your cash flow and adds pressure.

And high-interest credit cards? They quietly chip away at your future.

The truth is, debt keeps you stuck in the now — and long-term wealth is built by planning ahead.

What You Can Do Today

You may not be able to change the entire system, but you can change your system:

Start small: Automate savings, even $50/month, get the ball rolling, and worry about increasing it little by little every few months.

Avoid lifestyle creep: Don’t let your spending increase when your income rises.

Say no to bad debt as best you can and avoid reaching for the max you can get approved for; spend what’s comfortable and allows you to keep saving and increasing those savings.

Invest in learning: Financial literacy is a superpower.

Wealth isn't just for the wealthy. It's for the patient, the disciplined, and those willing to act.

Shean