Explaining the "One Big Beautiful Bill": What It Means for Your Taxes

In a sweeping move to reshape the American tax landscape, the United States Congress has passed what is being dubbed the One Big Beautiful Bill. This legislation, packed with changes that impact everything from your paycheck to your estate plan, is being praised by some for its broad tax relief and critiqued by others for its complexity.

Here’s a detailed breakdown of the key changes and what they mean for individuals and families across the country.

Permanent TCJA Provisions

One of the cornerstone features of the new law is the permanent extension of many provisions from the 2017 Tax Cuts and Jobs Act (TCJA). This means that the temporary relief enacted back then is now here to stay—with a few updates:

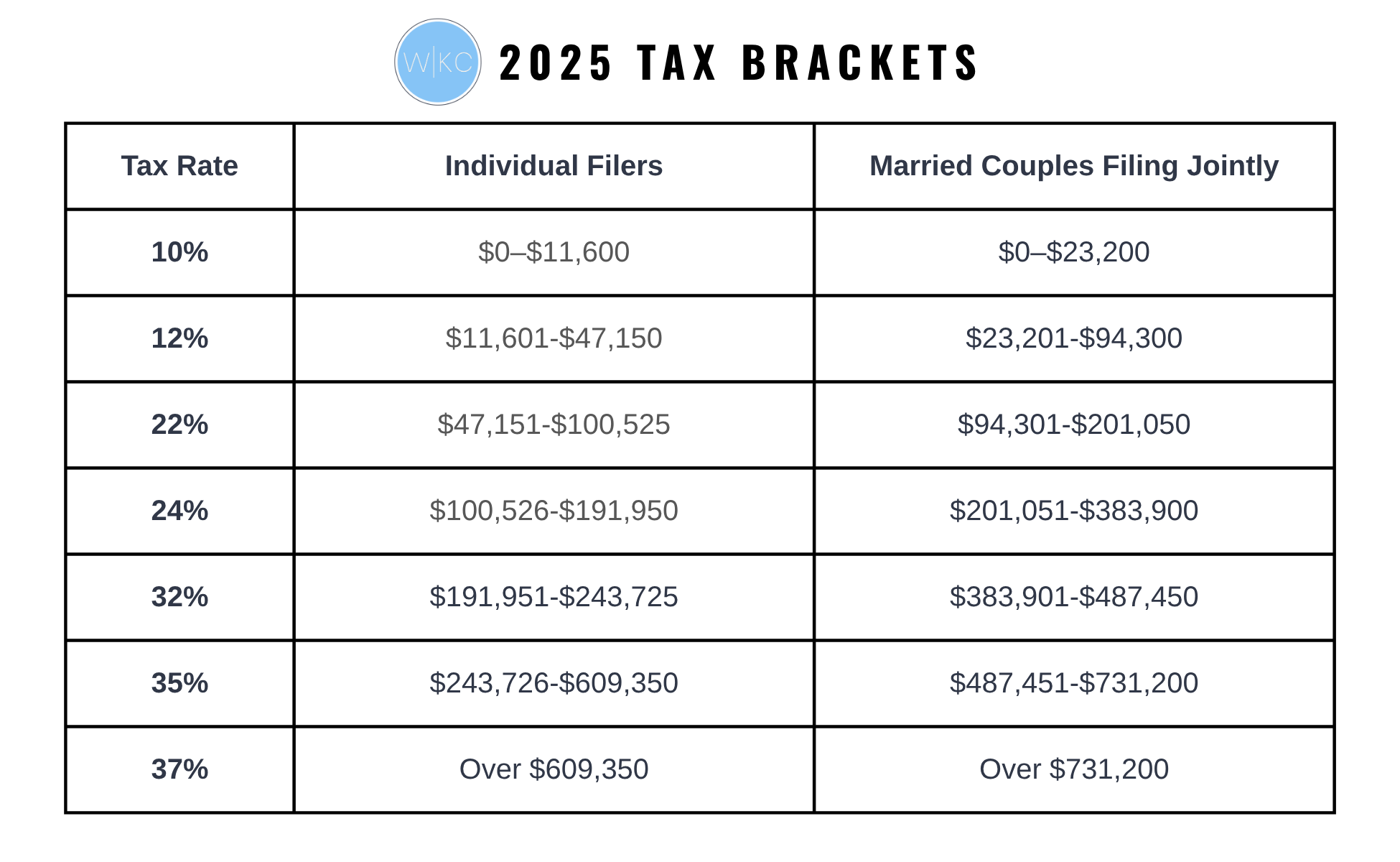

Updated Tax Brackets: The bill maintains the TCJA’s lower income tax brackets, making them permanent. Meaning they are no longer scheduled to sunset at any time in the future. While the exact rate structure remains largely intact, the thresholds for each bracket have been indexed and locked in at the rates below, indexed for inflation.

Versus the changes that would have occurred in 2026 if congress did not act.

Child Tax Credit: Increased from $2,000 to $2,200 per child, with $1,700 refundable—a significant boost for working families.

Standard Deduction:

Single: increased from $15,000 to $15,750

Married filing jointly: increased from $30,000 to $31,500

Estate & Gift Tax Exemption:

Single: increased from $13.99 million to $15 million

Married: increased from $27.98 million to $30 million

Social Security and Seniors

Contrary to some political slogans, this bill does not eliminate tax on Social Security benefits. Instead, it provides:

An additional $6,000 tax deduction for taxpayers over the age of 65, but:

Phases out at:

$75,000 MAGI for single filers

$150,000 MAGI for joint filers

Fully phased out at:

$175,000 (single)

$250,000 (joint)

Applies only from 2025 to 2028

SALT Deduction Cap Increased

For those in high-tax states, the increase in the SALT (State and Local Tax) deduction cap is a major win:

Cap raised from $10,000 to $40,000

Increases 1% annually until 2030, when it reverts back to $10,000

Phaseout begins at $500,000 of income

Applies to itemized deductions only

Deductible SALT items include:

State income or sales tax (choose one)

State and local property taxes

Motor vehicle license taxes

No Federal Tax on Tips (With Conditions)

In an effort to support tipped workers:

Up to $25,000 deduction per year for qualified tip income

Applies to those customarily receiving tips before Dec 31, 2024

Phaseout starts at $150,000 in income

Ends in 2028

No itemization required

Must include Social Security numbers (both spouses if filing jointly)

Only about 2.7% of the workforce receives tips, and 37% of those earn below the federal tax threshold

No Tax on Overtime Pay

Another major change is the overtime income deduction:

Deduction Amounts:

$12,500 for single filers

$25,000 for joint filers

Phaseout:

Begins at $150,000 single / $300,000 joint

Effective 2025–2030

Applies only to:

Overtime required by FLSA

Pay exceeding the regular rate

Does not include:

Overtime due to state law or collective bargaining agreements only

No itemization required

Cannot “double dip” by deducting both tips and overtime on the same income

Deduction for Auto Loan Interest

A new, unique provision allows individuals to deduct interest on certain auto loans:

Up to $10,000 per year (2025–2028)

Must meet all of the following:

Vehicle assembled in the U.S.

Must be a car, van, SUV, truck, or motorcycle under 14,000 lbs

Personal use only

First loan on the vehicle

Loan secured after Dec 31, 2024

Phaseout ranges:

$100,000–$150,000 (single)

$200,000–$250,000 (joint)

Stackable with Biden-era EV tax credit ($7,500)

Not eligible: ATVs, trailers, campers, salvage/parts vehicles

“Trump Accounts” for Newborns

This provision introduces a new form of savings for children:

Functions as a traditional IRA (not a Roth)

No withdrawals allowed before age 18

Annual contribution limits:

$5,000 per child

$2,500 additional from employers (within limit)

Contributions from tax-exempt organizations do not count toward the $5,000 limit

No contributions allowed after age 17

Pilot program: $1,000 federal contribution for every U.S. child born 2025–2028

The One Big Beautiful Bill brings an ambitious set of tax changes aimed at providing relief to families, seniors, and workers while also promoting savings and domestic investment. But as always, the devil is in the details—and the details here are plentiful.

While some provisions offer immediate and tangible benefits (like the SALT cap increase or child tax credit), others will require a more strategic approach to fully leverage (like the auto loan deduction or Trump accounts).

Consulting with a qualified tax and financial advisor will be crucial to navigate these new rules and optimize your tax position for the years ahead.

Will