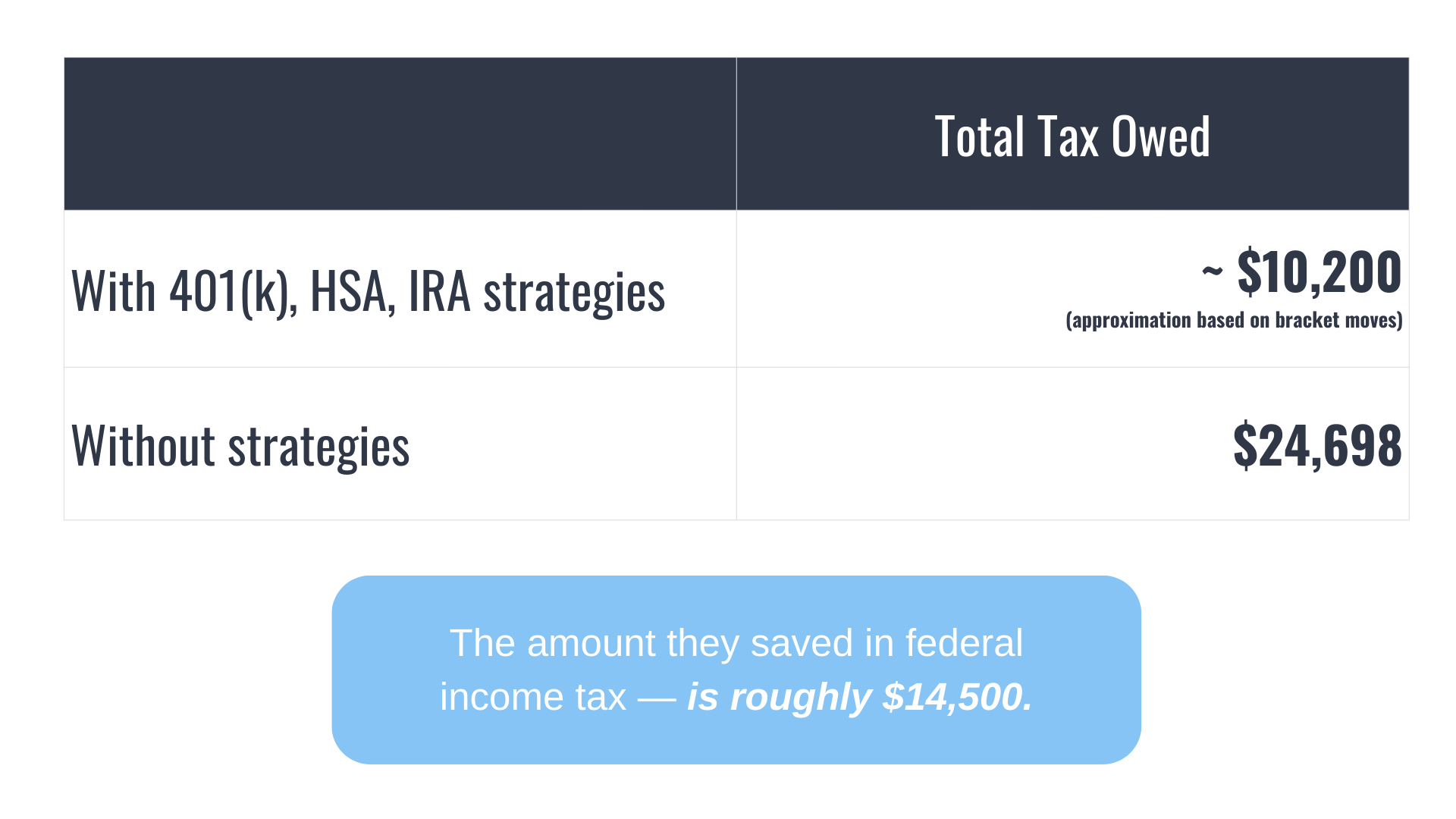

How A Couple Making $190,000 Reduced Their Tax Bill by Almost 60%

Many people assume that meaningful tax savings require secret loopholes. But sometimes the biggest opportunities are often hiding in plain sight.

Workplace retirement plans like 401(k)s, HSAs, and IRAs aren’t flashy — but they’re some of the most powerful and reliable tools in the tax code.

Most households never fully fund these accounts, which means they leave legitimate tax savings on the table every year. Thoughtful planning isn’t about finding tricks — it’s about consistently using the tools that already exist, in the right order, and at the right income level.

Let’s look at a married couple under 50 earning $190,000 in 2025 - both have access to 401(k) plans, they are covered by an HSA-eligible family HDHP, and their traditional IRA contributions are deductible. They file Married Filing Jointly, take the standard deduction, and fully fund the most powerful pre-tax and above-the-line savings vehicles available:

Traditional 401(k) contributions

HSA (family coverage)

Traditional IRAs (assumed deductible)

2025 contribution limits used in this example

401(k) employee contribution: $23,500 per person

Traditional IRA: $7,000 per person

HSA (family coverage): $8,550

Standard deduction: $31,500

Step-by-step deduction breakdown

Pre-tax retirement & health savings

(these reduce taxable wages and/or AGI)

401(k) contributions

$23,500 × 2 = $47,000

HSA contributions

$8,550

Traditional IRA contributions (deductible)

$7,000 × 2 = $14,000

Calculating their taxable income

Starting household income:

$190,000

>> Minus 401(k) contributions:

− $47,000 → $143,000

>> Minus HSA contributions:

− $8,550 → $134,450

>> Minus deductible IRA contributions:

− $14,000 → $120,450 AGI

>> Apply the standard deduction:

− $31,500

Taxable income:

$88,950

What tax bracket are they in for 2025?

For Married Filing Jointly, the 12% federal tax bracket in 2025 tops out at $96,950 of taxable income.

With $88,950 of taxable income, this couple is solidly in the 12% marginal federal tax bracket

(Important reminder for clients: this does not mean all income is taxed at 12%. Lower brackets still apply first.)

Why this matters

By intentionally maxing out tax-advantaged accounts, this couple:

Shelters $69,550 from taxes before even touching itemized deductions

Drops from a $190,000 income in the 22% bracket into a the 12% marginal bracket

Builds long-term retirement and healthcare flexibility while keeping today’s tax bill low

This is a great real-world example of how smart planning—not just income level—determines how much you actually pay in taxes.

Important caveat

If this same couple:

Did not max out their 401(k)s, or

Skipped the HSA

Their MAGI could easily land inside or above the phaseout, reducing or eliminating the IRA deduction.

So the deductibility here is a result of intentional planning, not luck.

The key rule that matters

Traditional IRA deductibility depends on two things:

Are you (or your spouse) covered by a workplace retirement plan?

What is your Modified Adjusted Gross Income (MAGI)?

For a married couple filing jointly in 2025, when both spouses are covered by employer retirement plans, the Traditional IRA deduction phases out between $123,000 and $143,000 of MAGI.

From the example we shared:

Gross income: $190,000

After 401(k) + HSA + IRA contributions:

MAGI ≈ $120,450

That number is below the $123,000 phase-out starting point.

Result:

Both spouses can take a FULL Traditional IRA deduction

$7,000 each

$14,000 total deductible

We see time and again, normal people using the tax code as it’s written — taking advantage of everyday tools to reduce what they owe at tax time while building toward long-term goals. While there are certainly more complex tax strategies available as income increases or situations are more complex, for most people, starting here creates a strong foundation and meaningful impact!

Will