Slowing Jobs, Strong Households: Finding Balance in Uncertain Times

Investors often look in the rearview mirror even when they know what lies ahead is most important. Recent reports, which look backward by nature, have sparked concerns about the economy, —leaving some people wondering if a recession could be around the corner.

Right now, the signals are mixed: job growth is slowing, inflation is still sticky, unemployment is low, but the economy continues to grow. This mix makes it even more critical for long-term investors to keep a steady, balanced perspective.

Analyzing economic data is challenging, and interpreting market factors is never straightforward. That’s why it’s often better to look past the headlines and focus on the underlying health of the economy.

A great place to start is with consumers (us, people like you and I spending money on everyday things) since our spending accounts for more than two-thirds of all economic activity. So, how are households holding up in today’s complicated environment?

The job market has weakened in recent months.

The latest jobs report shows the labor market slowing more than many expected. In August, only 22,000 jobs were added—far below the 75,000 economists had predicted. Moreover, earlier numbers were revised downward, showing that in June, the economy actually lost 13,000 jobs—the first monthly drop since 2020.

While those headlines sound concerning, economists don’t just look at month-to-month changes. They focus on trends and something called “labor market slack”—basically, how easy it is for people who want work to find it.

Fed Chair Jerome Powell described the job market as “a curious kind of balance.” Both supply and demand for workers are cooling, but unemployment is still just 4.3%, which is historically low. The underemployment rate (including discouraged workers) is also relatively low at 8.1%. And with roughly one job opening for every unemployed person, companies are clearly still hiring.

This suggests the labor market isn’t collapsing—it’s cooling off gradually. Historically, unemployment spikes have only happened after big shocks like the 2008 crisis or the 2020 pandemic. Today, things look more like a natural adjustment. But for the Fed, this cooling makes interest rate cuts in September more likely, hopefully easing some burden for households and small businesses, allowing economic growth to continue.

Consumer finances show resilience despite challenges.

Even as the job market softens, consumer finances tell a mixed story. Debt levels keep climbing—across credit cards, auto loans, student loans, and more. That naturally raises concerns, since household debt played a significant role in the 2008 financial crisis.

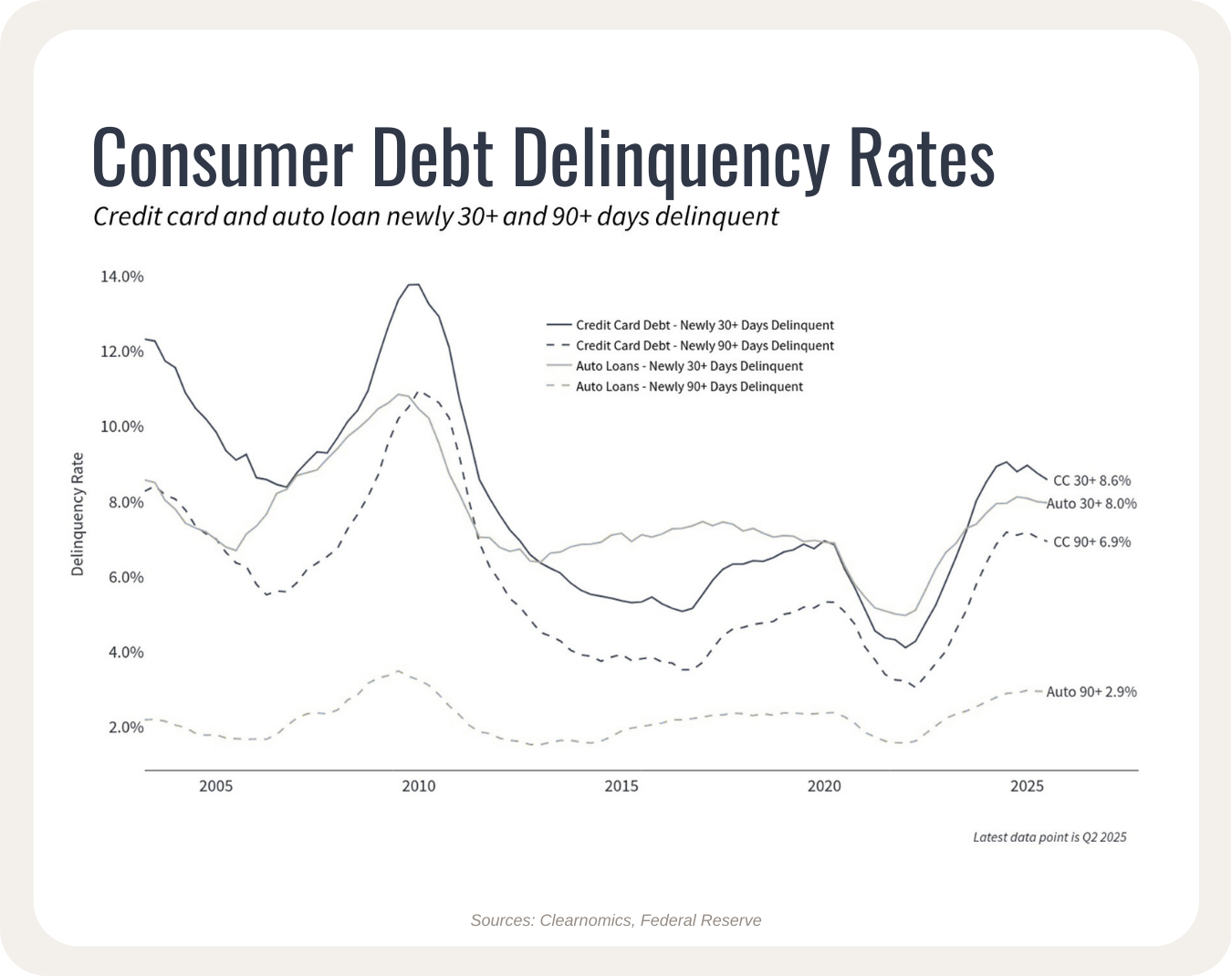

One warning sign is that more people are falling behind on payments. Credit card and auto loan delinquencies have risen over the past two years, especially among borrowers with lower credit scores. This reflects what some call a “two-speed economy,” where some households struggle more than others.

Still, these delinquency rates have recently leveled off and remain well below 2008. And while overall household debt is high, the amount people are paying each month on their debt has been steady. This means that, while some households are stretched, we’re not yet seeing the stress that typically leads to recessions.

Household net worth remains near record levels.

It’s easy to focus only on the debt side of the consumer story—but assets matter too. And today, U.S. household net worth is near record highs, totaling about $169 trillion. This growth has been fueled by steady economic expansion, rising home values, and a strong stock market.

Of course, not every household benefits equally. Those carrying more debt might not see their wealth increase, while others could see their wealth grow. However, the broader “wealth effect” still encourages spending and helps stabilize the economy.

This is one reason why many of the economic worries of recent years haven’t always led to downturns. Overall, the consumer is still in good shape, maybe not great, but good enough to keep the economy growing for now.

Process over predictions.

Shean