The Hidden Cost of Inflation—and How to Stay Ahead of It

When we think about natural disasters, earthquakes and erosion seem worlds apart. One is sudden and dramatic, while the other creeps in slowly over time. Yet both require foresight and preparation. The same is true for economic changes.

Some challenges strike quickly, while others quietly chip away at our financial state. Inflation is one of those forces—it can surge suddenly or slowly erode purchasing power, and right now, it’s doing a bit of both.

Why Inflation Matters

Many investors remember the high inflation of the 1970s and early 1980s—or more recently, the price spikes that followed the pandemic. Today, inflation remains stickier than many would like. Tariffs may continue to pressure consumer prices, yet the economy is still supported by strong employment, healthy spending, and solid corporate profits. This push-and-pull creates complexity for policymakers, and it reminds investors that inflation never exists in isolation.

At its core, inflation reduces the future value of every dollar you hold. A dollar a century ago would buy 18 times less today. Even moderate inflation of 2–3%—the level often considered “healthy” for the economy—chips away at savings and can double the cost of goods within a typical retirement timeframe.

This erosion is especially tough for retirees and savers holding large amounts of cash. It creates a “hurdle rate”—the minimum return your investments need to earn to keep pace.

What the Latest Numbers Tell Us

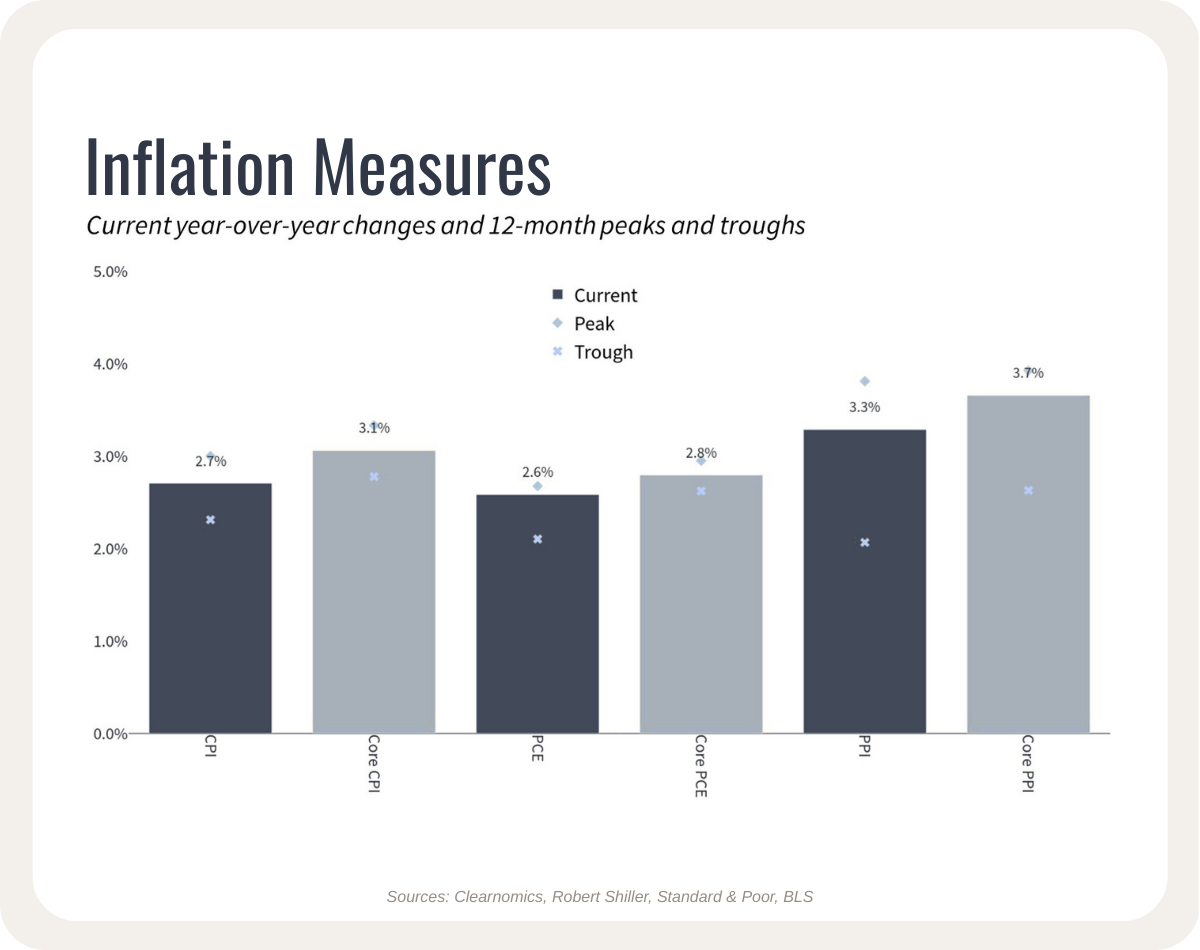

Many are watching today to see if tariffs will hit inflation like an “earthquake.” The latest Producer Price Index report gives us a glimpse: wholesale prices jumped 0.9% in July—the most considerable monthly increase since mid-2022 and well above expectations. Goods rose 0.7%, while services climbed 1.1% in a month.

Why does this matter? Wholesale price increases often show up later in consumer prices. Many businesses have absorbed the extra costs for now, but the data suggests they may start passing more of these expenses along to households.

The Consumer Price Index paints a slightly calmer picture but still shows inflation holding firm. Headline inflation rose 2.7% over the past year, or 3.1% when excluding food and energy, which have been relatively flat. Much of this stickiness is tied to shelter costs, especially housing.

While these percentages can feel abstract, reality shows up in everyday budgets. Over the past year, restaurant meals are up 3.9%, medical care 3.5%, car insurance 5.3%, and even furniture has risen 3.4%. For families already stretched by years of higher costs, these increases add real pressure.

How Investors Can Respond

Even with the recent uptick, today’s inflation is still far from the double-digit levels we saw in 2021 and 2022. That said, tariffs and other pressures may slowly push average prices higher over time. This gradual erosion is especially tough if wages don’t keep pace—or if portfolios aren’t structured to outgrow inflation.

One of the clearest examples is cash. Interest earned on cash has rarely kept up with inflation, and today there’s still a record $7.1 trillion sitting in money market funds—even as short-term rates have started to decline. Simply put, cash alone isn’t enough to protect purchasing power.

History shows that stocks and bonds have outpaced inflation over the long run, although not without volatility. Just look at 2022, when stocks struggled in the face of inflationary pressure. This is why balance matters: diversifying across asset classes helps investors weather both inflation and market swings.

Most importantly, avoid the temptation to react to every monthly inflation report or tariff headline. Making sudden shifts often leads to poor timing and missed opportunities. Instead, keeping portfolios thoughtfully positioned for a range of scenarios—and staying focused on long-term goals—is the best way to navigate inflation with confidence.

Inflation is less of an earthquake and more of an erosion—it chips away at purchasing power steadily, year after year. The best defense isn’t guessing what next month’s report will say, but building a financial plan and portfolio designed to outpace inflation over decades.

Process over predictions.

Shean