The Importance of Earnings on Long-Term Portfolios

As earnings season gets underway, the market’s attention is shifting away from geopolitics and back to something much more concrete: how companies are actually performing.

With stocks sitting near all-time highs, investors are naturally asking two big questions — are valuations stretched, and can today’s profit growth really last?

It’s still early, but initial reports suggest companies wrapped up 2025 in solid shape. Wall Street expects S&P 500 earnings per share to reach a new record, which is encouraging.

Think of earnings reports as corporate report cards — they tell us how well companies are executing and whether their strategies are paying off. Investors pay close attention because these numbers help determine how stocks and bonds are priced.

For long-term investors, earnings growth has always been the engine behind stock market returns and long-term wealth creation. That said, the results of any single company matter far less than what earnings trends tell us about the bigger picture. Corporate profits offer insight into economic growth, consumer demand, business investment, and whether the current market environment is sustainable.

So what should investors focus on as new earnings roll in?

Strong earnings growth supports portfolios

Earnings are the link between the economy and investment portfolios.

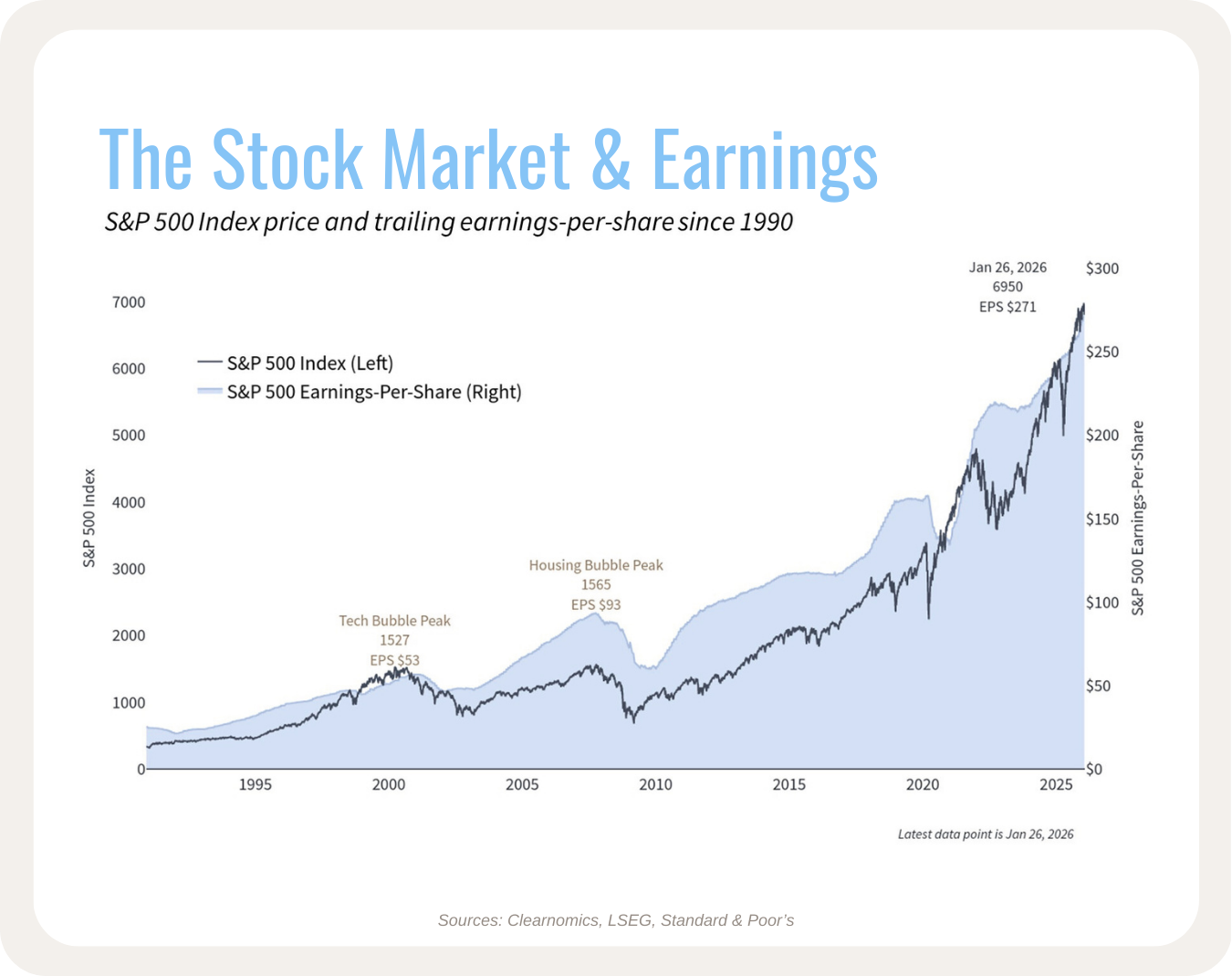

When economists talk about GDP growth, jobs, or consumer spending, those trends ultimately show up in corporate profits. A healthy economy typically leads to stronger sales and earnings — exactly what we’ve seen in recent years. Since owning stocks means owning a share of those profits, stock prices tend to rise as earnings grow.

This relationship holds true not just for individual companies, but for the market as a whole. Over long periods, stock prices tend to track earnings growth. In fact, the steady expansion of the U.S. economy is one of the main reasons the stock market has risen over time.

So far this earnings season, about 13% of S&P 500 companies have reported results for the fourth quarter of 2025, and roughly 75% have exceeded expectations, according to FactSet. Consensus estimates point to earnings growth of about 8.2%, marking the tenth straight quarter of earnings growth. Looking at all of 2025, earnings are expected to have grown by roughly 13%, with projections of around 15% growth in both 2026 and 2027 — well above the long-term average of about 7.7%.

If those trends hold, they represent healthy earnings growth that continues to support investor portfolios.

Earnings growth can help justify valuations

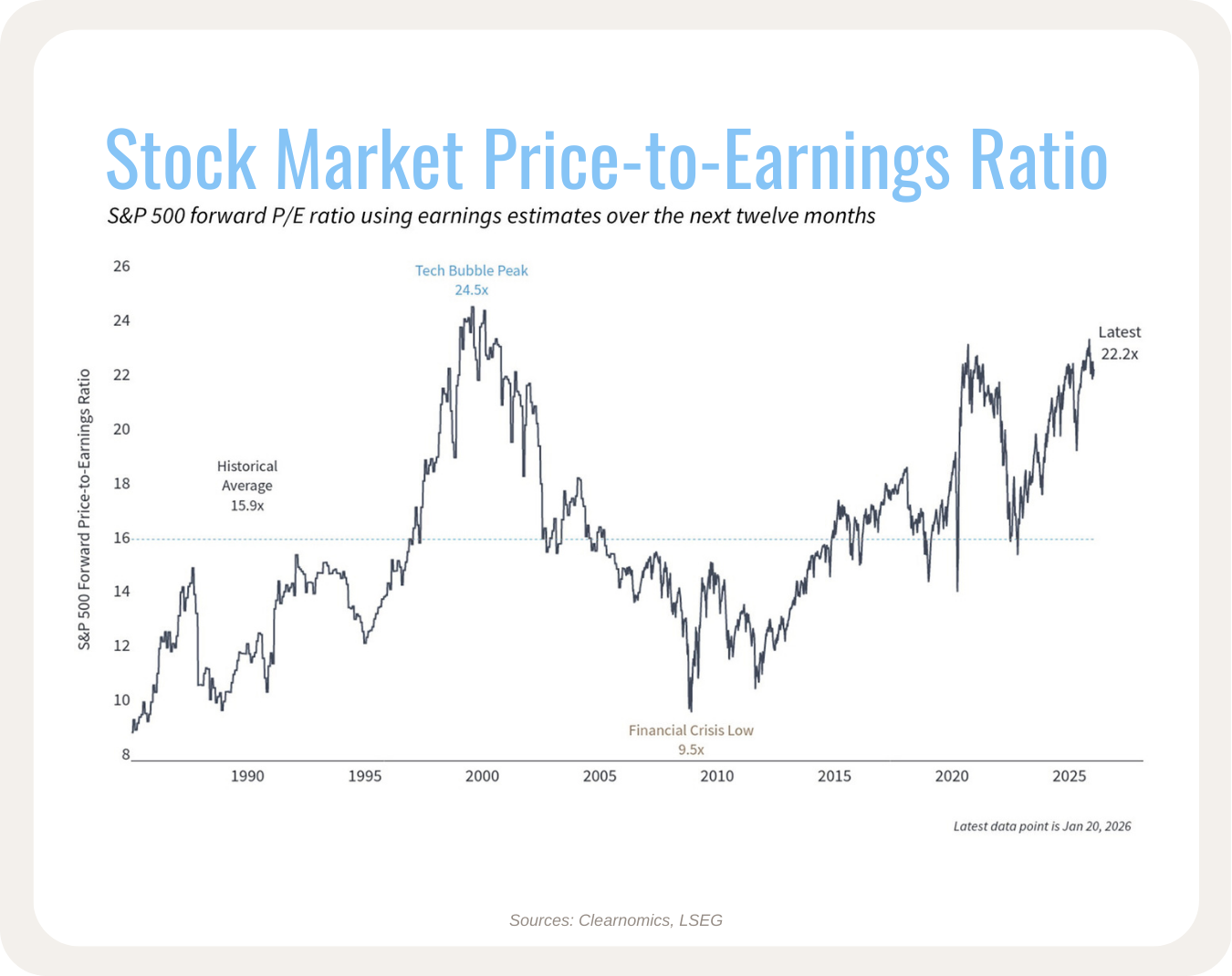

Earnings season also gives investors a clearer picture of valuations. While earnings drive long-term returns, valuations help explain short-term market movements. In simple terms, valuation measures how much investors are willing to pay for earnings. The most common example is the price-to-earnings (P/E) ratio.

Today, the S&P 500 trades at about 22 times earnings — well above its historical average of 15.9 and not far from levels seen during the dot-com bubble. That sounds elevated, but there’s an important difference: today’s valuations are supported by real earnings growth, unlike periods when profitability was largely ignored.

This helps explain why markets can be volatile even when the fundamentals haven’t changed. Often, earnings expectations stay the same while prices move, causing valuations to rise or fall. That’s also why markets can rebound quickly from short-term pullbacks — and why staying invested, or even adding during downturns, can be beneficial when valuations become more attractive.

Looking back at 2025, the S&P 500 rose about 16.4%. If earnings grew by roughly 13%, that means earnings accounted for about 80% of the market’s price gains, while higher valuations contributed closer to 20%. In other words, portfolios benefited mainly because companies performed better — not just because investors were willing to pay more.

That said, higher valuations do mean there’s less room for disappointment. When expectations are high, markets can swing more sharply during periods of uncertainty. This doesn’t argue against investing in stocks, but it does reinforce the importance of diversification and risk management.

AI investment continues to shape the outlook

While earnings reports tell us what already happened, markets are always looking ahead. That’s why guidance from company executives often matters as much as the numbers themselves — especially around major trends like artificial intelligence.

Companies are investing heavily in AI infrastructure, including data centers and advanced computing hardware. These investments are reshaping not just the tech sector, but the broader economy. Large “hyperscalers” are betting that demand for AI services will continue to grow, potentially driving earnings higher for years to come.

Of course, there are risks.

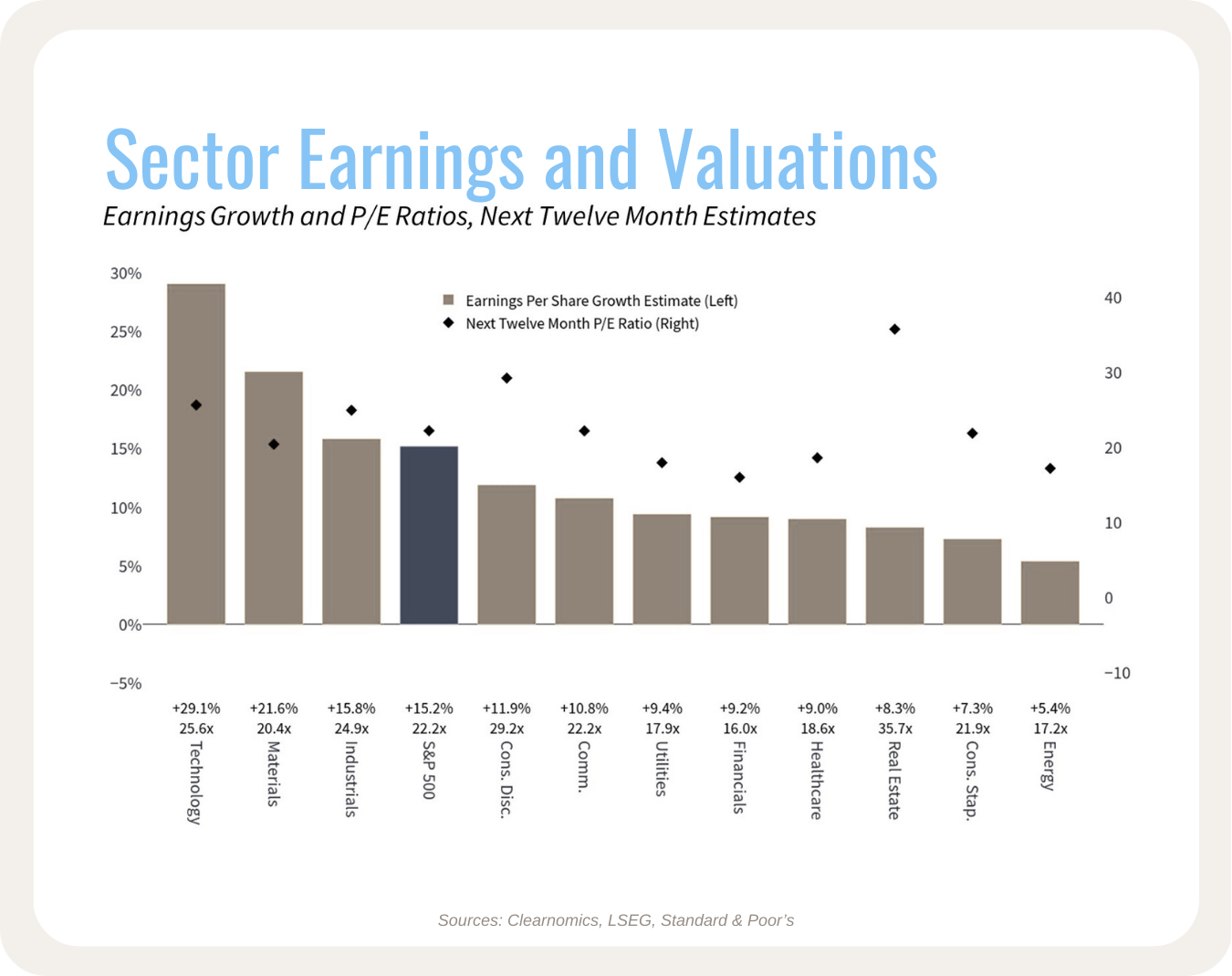

If AI adoption takes longer than expected, companies could see pressure on margins and returns. Earnings growth expectations already vary widely by sector, with technology companies expected to lead the way.

The full impact of AI on productivity and economic growth will unfold over time. Investors who stay focused on long-term goals — rather than reacting to every earnings headline — are better positioned to benefit from these trends.

Strong corporate earnings have played a key role in supporting the stock market. With valuations elevated and uncertainty always present, the focus remains on building balanced portfolios that manage risk while staying aligned with long-term financial goals.

Process over predictions.

Shean