Trade Tensions Continue and Market Swings: What Investors Should Know

The market recently had its biggest one-day drop since April. The selloff was triggered by rising tensions between the U.S. and China over rare earth metals and new tariff threats. While that caused a brief stir, stocks quickly bounced back after the White House softened its tone. For long-term investors, these ups and downs may feel familiar after a stretch of relative calm.

Despite trade-related uncertainty this year, markets overall have performed very well. The S&P 500, Nasdaq, and Dow have all posted double-digit gains. Bonds have also been a bright spot, with the Bloomberg U.S. Aggregate Index up 6.7%—an unusually strong year for fixed income. International markets have done even better, with developed and emerging markets rising 21.9% and 27.0%, respectively.

The takeaway—one bad day or a wave of negative headlines shouldn’t dictate your investment strategy.

Why Markets Reacted: Rare Earth Metals & Trade Tensions

The latest bout of volatility came after China restricted exports of rare earth metals—materials essential for many modern technologies. In response, the White House threatened an additional 100% tariff on Chinese goods, adding to existing duties. This ongoing back-and-forth has kept investors uneasy, but recent comments from the administration suggest negotiations may resume soon.

Rare earth metals play a key role in smartphones, electric vehicles, batteries, and even military systems. While these elements aren’t truly “rare,” China dominates their production and processing—controlling about 70% of global output and nearly 90% of refining capacity. That gives China significant leverage in trade discussions.

The U.S. has begun building its own supply chain for these materials, but progress will take time. Meanwhile, efforts to reduce the U.S. trade deficit with China and bring manufacturing jobs back home have had mixed results. Some factories have reopened, but overall manufacturing employment has dropped by about 78,000 jobs this year.

For investors, it’s hard to know whether new tariff threats will stick or if they’re simply negotiating tactics. That’s why it’s wise to stay patient and avoid reacting to every headline—just as investors who stayed the course during the 2018–2019 trade tensions were ultimately rewarded.

We Know Volatility Is Normal & Can Even Be an Opportunity

After months of calm, market volatility has started to rise again. Concerns about high stock valuations—especially among AI-related companies—have investors on edge. But history shows that market pullbacks often create opportunity.

When volatility spikes, valuations often fall, which can make for attractive long-term entry points. The VIX index, a common measure of market volatility, has historically shown that when fear runs high, the following year’s returns tend to be strong. In other words, moments of panic often pave the way for future growth.

Putting It All in Perspective

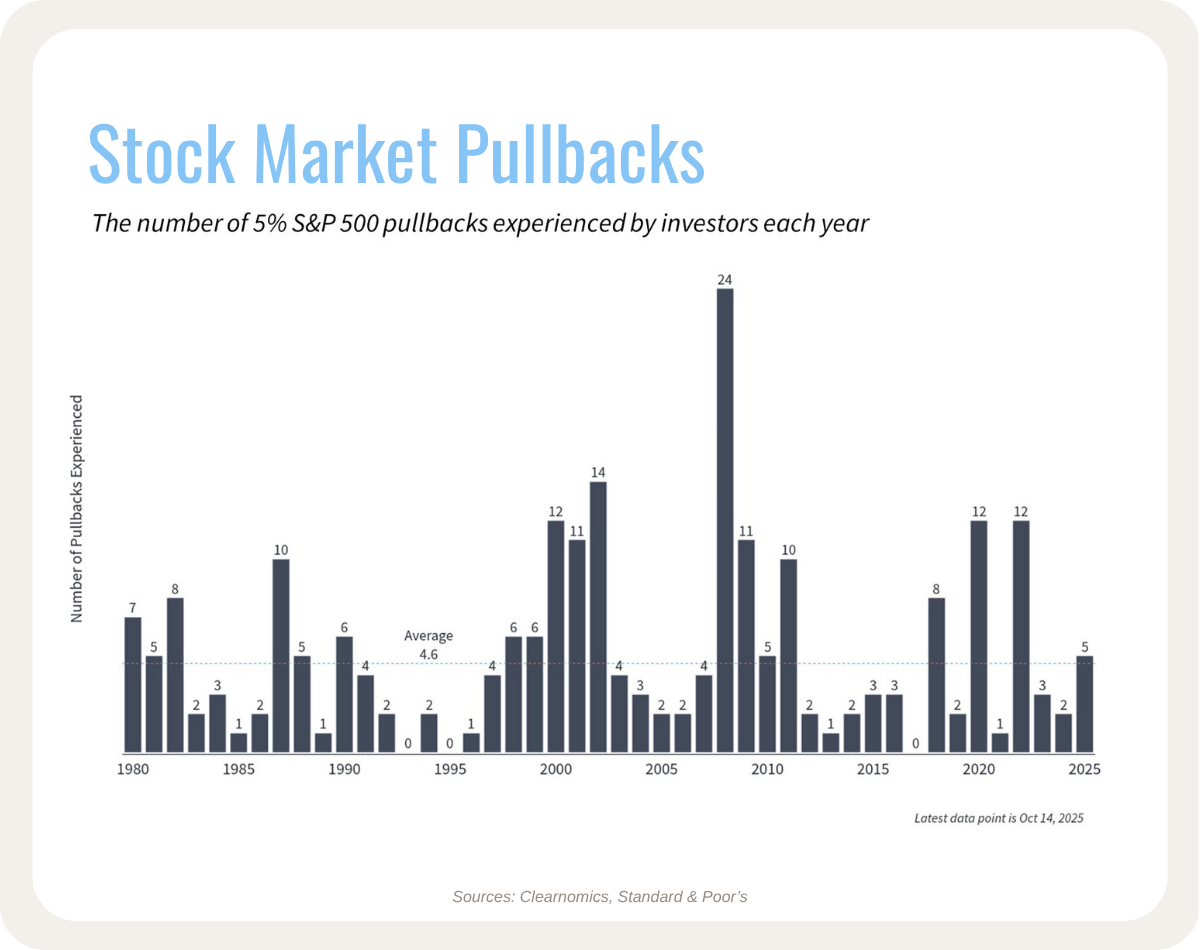

The 2.7% drop on Friday, October 10th may have felt dramatic, but it was only the fourth-worst day of the year—and far from unusual. Market pullbacks of 5% or more happen regularly, even in strong years.

Despite occasional dips, the S&P 500 is still up 31.5% from its April low and has hit more than 30 new all-time highs this year.

The market never moves in a straight line. Short-term uncertainty is part of the investing journey. The key is to stay focused on your long-term goals and avoid letting fear or headlines dictate your next move.

Process over predictions.

Shean