Venezuela and the Markets: Staying Grounded Amid Global Events

Recent headlines around Venezuela have understandably grabbed a lot of attention. Any major geopolitical development—especially one involving the U.S.—can feel unsettling. Beyond the political and humanitarian implications, it’s natural for investors to wonder what this means for the markets and their portfolios.

Situations like this raise big-picture questions:

How involved will the U.S. become in the region?

Could this lead to political change in Venezuela?

What might it mean for global energy markets or international relationships more broadly?

While those questions matter, the reality is that the answers tend to unfold slowly and often in unexpected ways.

What history consistently shows is that geopolitical events often create short-term uncertainty, but they rarely change the long-term direction of financial markets.

Markets tend to react quickly to new information, but over time they refocus on fundamentals like economic growth, corporate earnings, inflation, and interest rates. We’ve seen this pattern play out repeatedly over the years, even during periods of heightened global tension.

Because these events feel dramatic and fall outside the usual flow of economic news, they can seem more threatening than they ultimately prove to be from an investment standpoint. That emotional reaction is completely human—but it’s also why perspective matters so much.

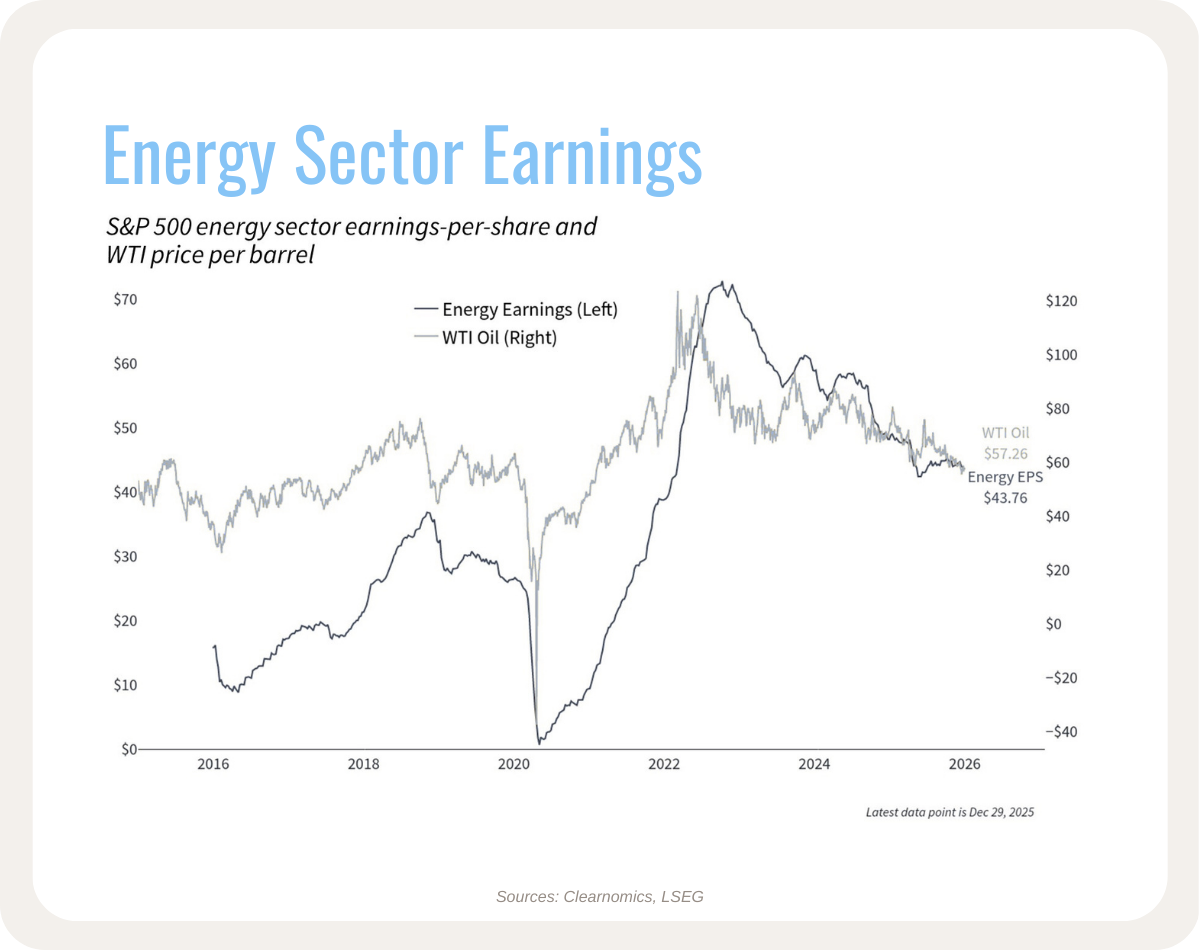

Energy is often the main link between geopolitics and markets, since oil and gas remain important inputs for the global economy.

Changes in supply expectations can move prices in the short run, but meaningful shifts typically take time. Infrastructure, investment, and global coordination all play a role, which means market impacts are usually more gradual than headlines suggest. Just as importantly, energy prices are influenced by many factors at once, making them notoriously difficult to predict.

It’s also worth noting that not every country at the center of global news has a large footprint in global financial markets, Venezuela being one of those countries. In many cases, the direct exposure for diversified investors is limited, and any market effects tend to show up indirectly—through sentiment or commodities—rather than through stocks or bonds tied to that country itself.

The takeaway for investors is not to ignore world events, but to keep them in context. Uncertainty is a normal part of investing, and geopolitical developments are one of many variables markets digest over time. Trying to react to every headline can be far more damaging than staying anchored to a well-constructed plan.

While developments in Venezuela are significant from a humanitarian and geopolitical standpoint, history suggests that long-term diversified portfolios have weathered these events fairly easily, and no change to the current investment approach is warranted.

As always, process over predictions.

Shean