What the Fed Rate Cut Means for Long-Term Investors

The phrase “don’t fight the Fed” has been around since the 1970s, and it’s just as relevant today.

The idea is simple: the Federal Reserve (the Fed) has a big influence on the economy and markets through its interest rate decisions. Because of that, it’s important for investors to pay attention—but without overreacting to every single announcement. What matters most is the overall direction of interest rates over time.

Right now, the Fed is in the middle of a rate-cutting cycle as it tries to support growth in a complicated economic environment.

The Latest Fed Move

Yesterday, the Fed lowered rates by 0.25%. This wasn’t a surprise—markets expected it.

What makes this moment unique is that the Fed isn’t responding to a crisis, like it did during the 2008 financial meltdown or the 2020 pandemic. Instead, it’s making a careful adjustment to help the economy keep moving forward, even as markets sit near record highs and economic signals are mixed.

Why the “Why” Matters More Than the “When”

Fed officials look at growth, jobs, and inflation when deciding policy. Right now, opinions are split, both inside and outside the Fed, about how quickly rates should come down. Even with this disagreement, there are a few important takeaways for investors:

This was expected. The Fed has signaled for a while that rate cuts were likely in 2025, and projections still point to more cuts this year.

This isn’t a crisis response. Today’s cuts are about steering the economy, not saving it.

Leadership is shifting. Fed Chair Jerome Powell’s term ends in 2026, and changes in leadership could mean different approaches. Still, long-term interest rates depend more on market and economic forces than on the Fed alone.

Mixed Signals from the Economy

The main reason for this latest cut?

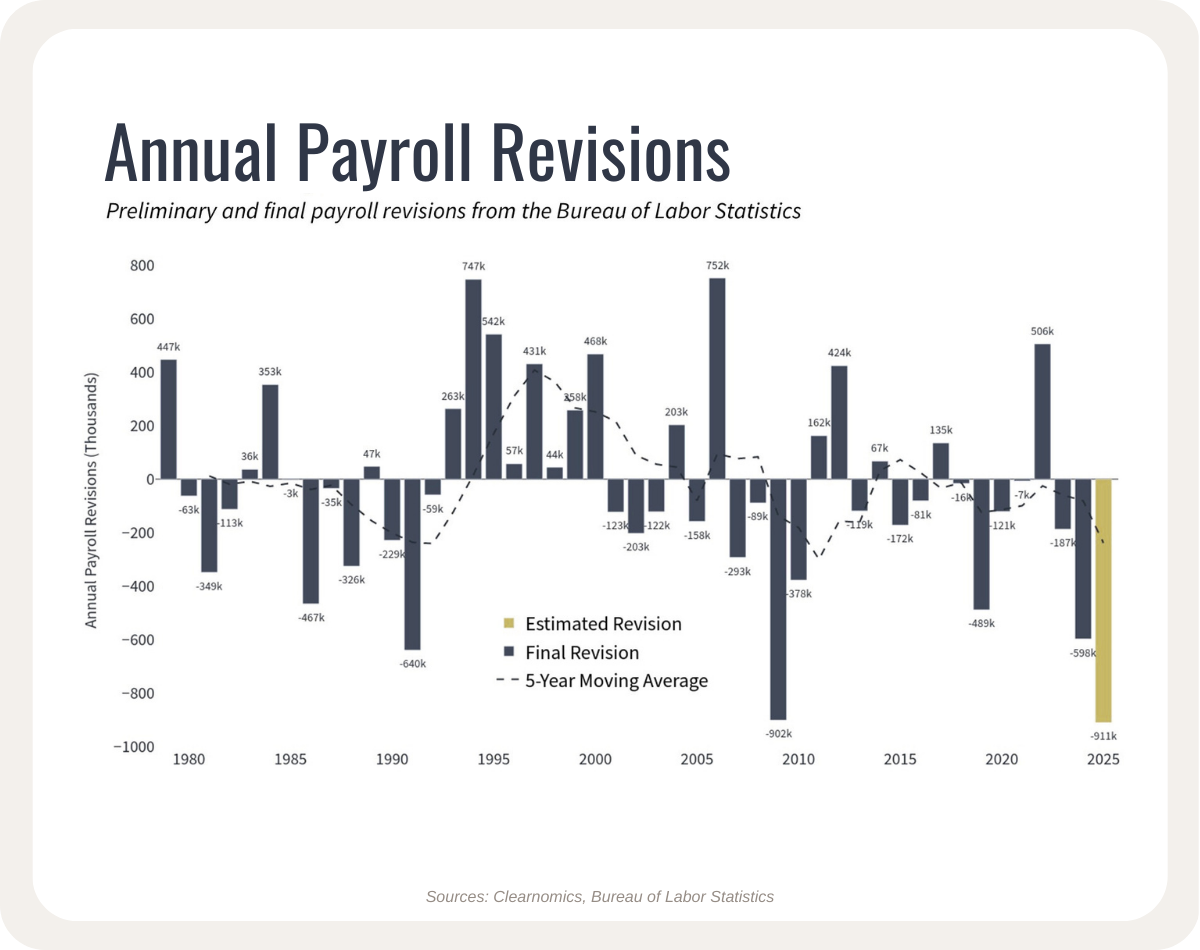

A cooling job market. August saw just 22,000 new jobs—far below expectations—and earlier job numbers were revised down. That said, unemployment is still relatively low compared to past downturns, which suggests a gradual slowdown rather than a crisis.

At the same time, inflation remains sticky. The Fed’s preferred measure sits at 2.6%, above its 2% target, with other inflation gauges showing similar trends. Balancing weaker jobs with higher inflation is exactly the challenge the Fed faces.

What This Means for Investors

Here’s the good news—rate cuts often provide support to markets. Lower rates make borrowing cheaper, boost consumer spending, and generally help businesses grow. That said, today’s cuts are happening at a time when stocks are already near all-time highs—an unusual but not unheard-of scenario.

History shows that in these situations, markets often still benefit.

Stocks may see gains as companies’ borrowing costs fall, and bonds may look more attractive as rates ease. The trade-off? Cash becomes less rewarding since yields fall.

This rate cut doesn’t mark a dramatic shift—it’s part of a gradual path the Fed has been signaling for some time.

Process over predictions.

Shean