What’s Really Behind U.S.–China Tensions?

Trade tensions between the U.S. and China have been heating up lately. Both countries have sharply increased tariffs—extra taxes on imported goods. Right now, the U.S. is charging a 145% tariff on products from China, and China has responded with a 125% tariff on goods from the U.S.

These moves are shaking up global financial markets, and the situation is changing fast. While this kind of global conflict can feel unsettling, history reminds us that the market has bounced back from similar situations before. For long-term investors, keeping a clear view of the bigger picture—especially the deep economic ties between the U.S. and China—can help keep things in perspective.

U.S.-China trade tensions are now in focus

Recently, rising tariffs—taxes on imported goods—have been dominating headlines. But with a 90-day pause on most new tariffs, the spotlight is now firmly on the trade relationship between the U.S. and China.

This issue goes beyond trade policy. What’s really happening is a major shift in global power. For decades, the U.S. was the world's only dominant superpower. But now, we’re in a “multipolar” world, where both the U.S. and China hold enormous economic and political influence. This new dynamic creates both challenges and opportunities for both countries.

Why This Trade Tension Feels Different

We don’t know exactly how things will unfold in the months ahead, but for long-term investors, keeping a big-picture view is essential. Despite the political drama, the U.S. and China are still closely connected through trade, financial systems, and global supply chains.

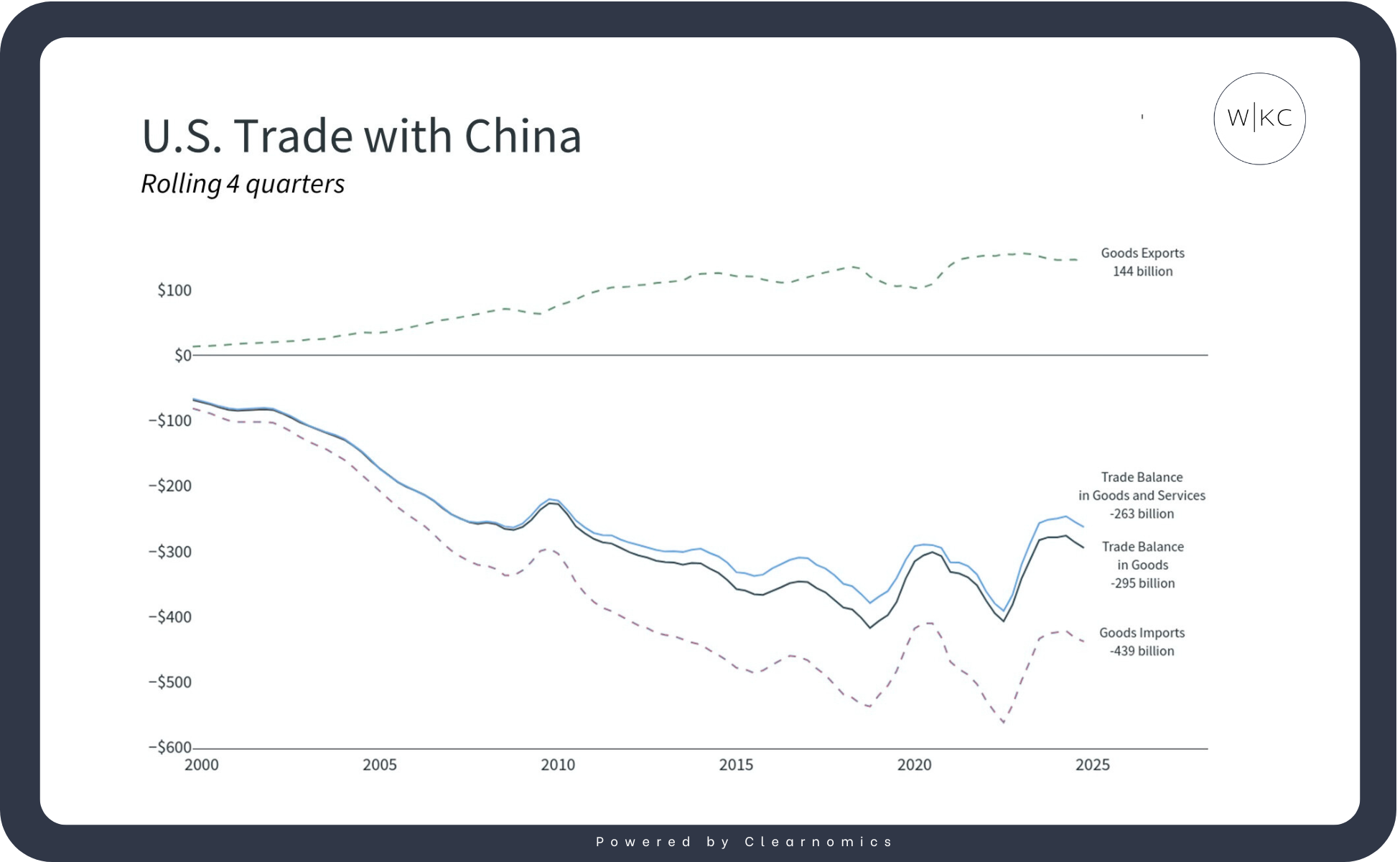

What makes today’s trade tensions different from those in the past is the size of the tariffs and the broader political context. As the chart shows, the U.S. has a large trade deficit with China—meaning we import far more than we export. Tariffs over 100% can more than double the price of products moving between the two countries. That means higher prices for everyday goods, higher costs for businesses, and slower economic growth. These fears—along with concerns about inflation and shrinking business profits—have created some big swings in the stock market recently.

Is This Just a Tough Negotiation Tactic?

There’s also been anxiety about how far the U.S. government might go in this trade standoff. Tariffs this high aren’t likely to last forever, so many experts believe this could be part of a negotiation strategy. The 90-day break from new tariffs (excluding China) and the exemption for certain tech products suggest the main goal is still to strike deals.

Looking Back to Look Forward

We’ve been here before—sort of. In 2018 and 2019, similar tariffs were introduced. Companies adapted by changing suppliers, rerouting supply chains, or absorbing some of the cost increases. While the market dipped in 2018, it bounced back strongly in 2019 and during the post-COVID recovery. Even though tariffs are broader now and may be tougher for businesses to work around, the strong market rally after the recent pause shows that investors still have hope.

Opportunities in a Shaky Market

For investors who are focused on the long term, tough markets can offer some silver linings. Stock prices have come down, making many investments more attractively priced—especially in key areas like tech and communication services that led the last bull market. And while rising interest rates have made the bond market more volatile, they’ve also opened up new opportunities to earn income from investments.

China's economy faces many challenges

While much attention is on how the U.S. is handling trade tensions with China, it's important to remember that China is facing its own economic challenges.

The country is still dealing with concerns about a real estate bubble and a shaky post-pandemic recovery. Its economy grew only 5.4% at the end of 2024, and many experts doubt it will meet the government’s 5% growth goal for 2025.

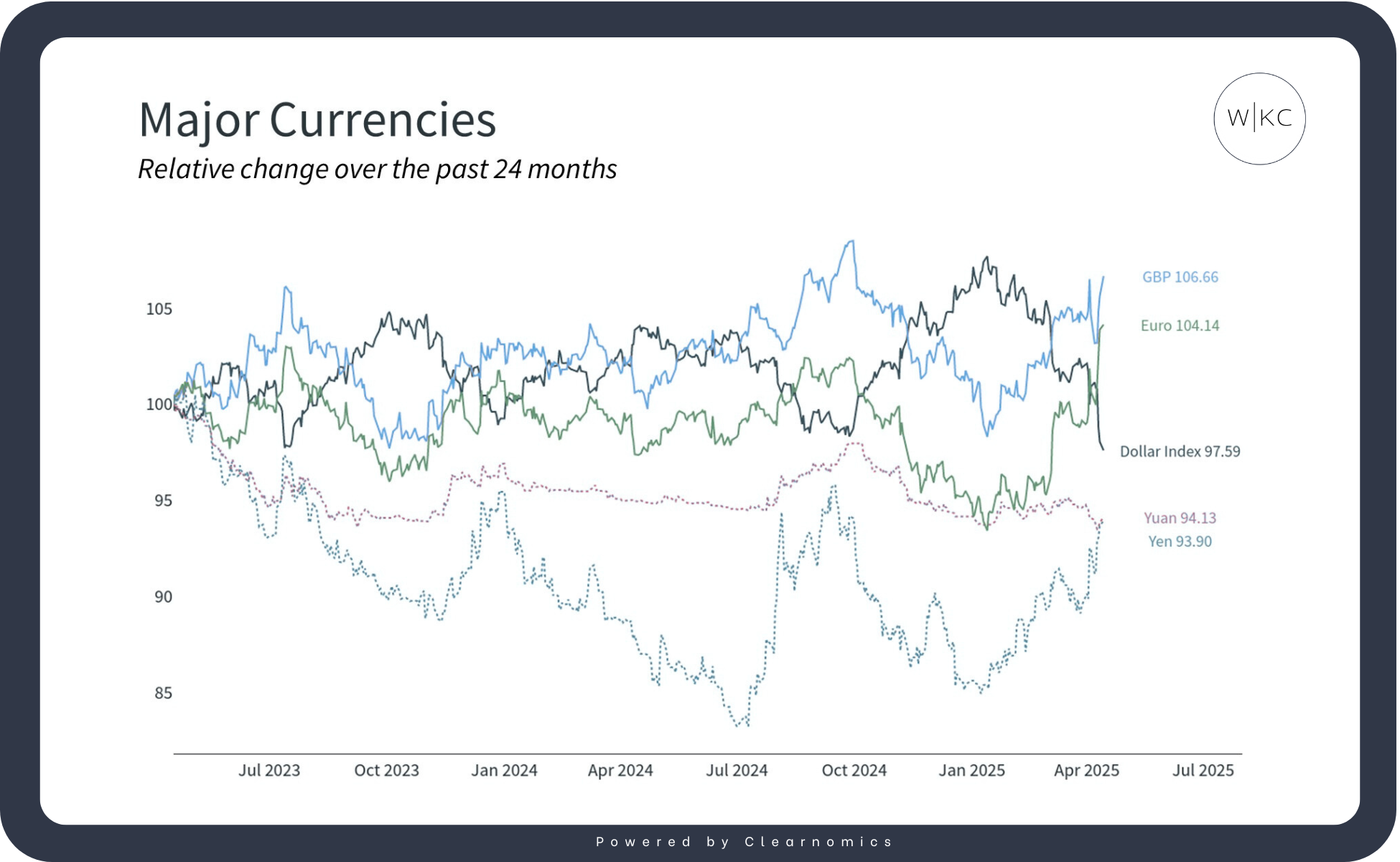

To support the economy, China has already launched a major stimulus plan and cut interest rates. Its central bank has also let the yuan weaken, making exports cheaper but increasing the risk of money leaving the country and possibly frustrating U.S. officials.

Looking at currency trends, both the yuan and the U.S. dollar have slipped—an unexpected move, since tariffs usually push the dollar higher by reducing imports.

Most U.S. debt is held domestically

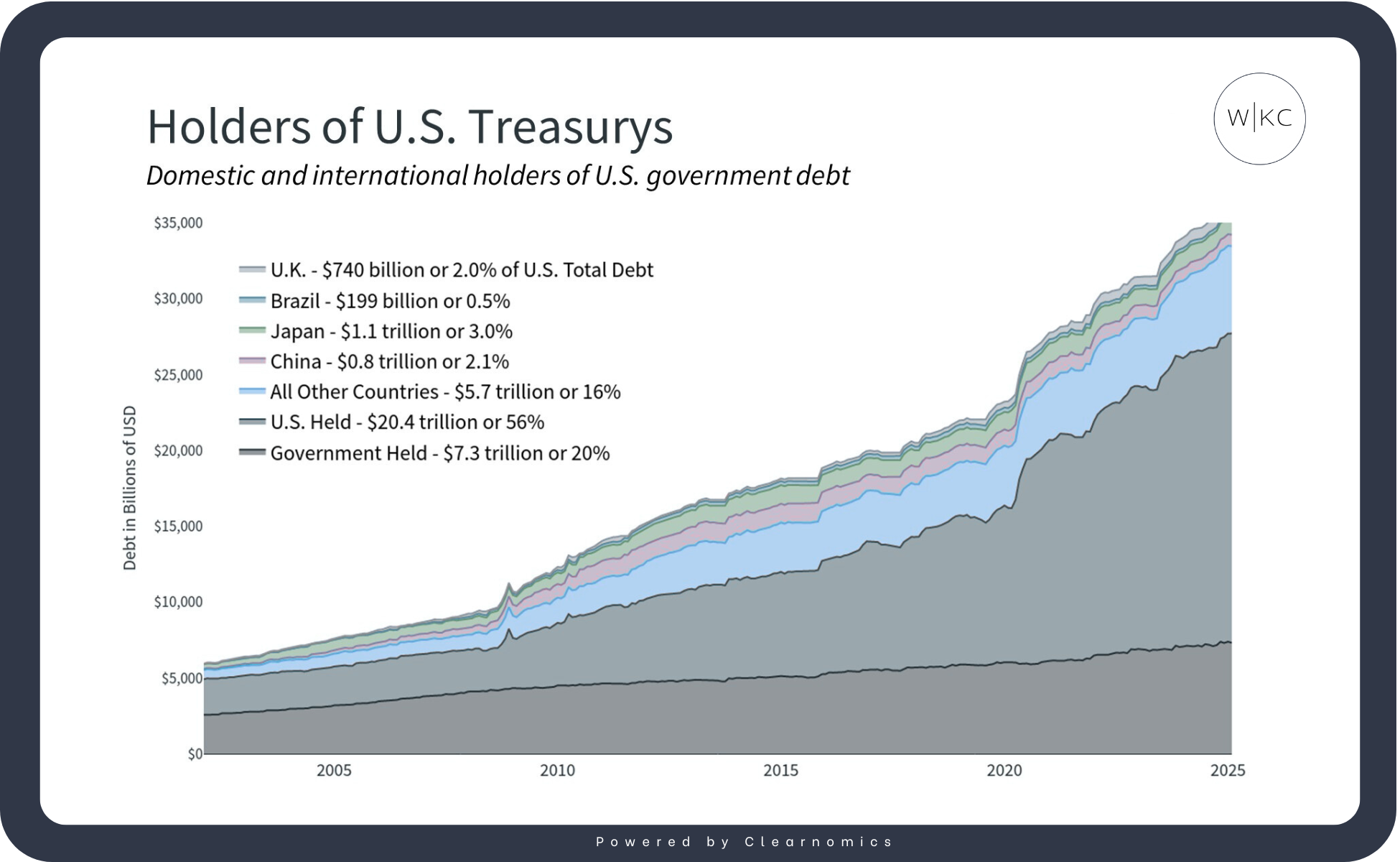

Some people worry that China could have too much influence over the U.S. economy because it owns a lot of U.S. government debt. There have even been rumors that recent changes in the bond market are caused by countries like China selling off their U.S. Treasury bonds. But here’s the reality: China owns only about 2.1% of all U.S. government debt. That’s a small amount, especially when you consider that most of the debt is actually owned by Americans—through individuals, businesses, and government programs.

What Happens If China Sells U.S. Debt?

If China did decide to sell a large chunk of its U.S. bonds, it might cause a short-term market reaction and could briefly push up interest rates. But in reality, countries like China hold U.S. Treasuries and dollars for a good reason—they help keep their own economies stable.

U.S. government bonds and the dollar are seen around the world as "safe" places to invest, especially during times of uncertainty. This has remained true even with challenges like inflation, government budget debates, and credit rating downgrades in recent years.

Yes, the ongoing tensions between the U.S. and China can make markets unpredictable in the short term. But understanding that and being prepared with a plan and well-diversified portfolio that matches your long-term financial goals is still the smartest way to handle global ups and downs.

Process > predictions.

Shean