How Corporate Earnings Reflect the Impact of Tariffs

Investors always keep an eye on corporate earnings to gauge how businesses are doing—but this earnings season matters even more than usual. Why?

Tariffs.

Even though stock markets have been hitting record highs as trade tensions ease, there’s still a lot of uncertainty around how tariffs might impact both businesses and consumers. The good news? New trade agreements are starting to roll out, and many companies are reporting stronger-than-expected earnings.

Consumers Are Still Spending, and Companies Are Still Growing

Recent data shows that consumer spending is holding steady, and corporate earnings are growing faster than anticipated. As of July 23, the average tariff consumers face is over 20%—the highest since 1911. Yet, this isn’t showing up in spending habits.

Why not? Many businesses are choosing to absorb these costs themselves instead of passing them straight to customers. That’s possible because profit margins are still strong.

So far, about a third of S&P 500 companies have reported second-quarter earnings—and 80% of them beat expectations. Overall earnings are up 6.4%, compared to forecasts of 4.9%. While that’s a little slower than recent quarters, it’s still solid—and it helps ease fears of a potential “earnings recession” like we saw in 2020 and 2022.

Tariffs: Who Pays and How It Affects You

Tariffs may be paid to the government, but the real cost is carried by either the exporting country or by U.S. consumers and businesses. It comes down to who has more “pricing power.”

Take rare earth metals, for example—critical for electronics and mostly imported. Since we don’t have many alternatives, any tariff likely means higher prices for consumers. That’s why trade talks with countries like China on these materials are so important.

On the flip side, in competitive industries like autos, companies often absorb some of the costs to stay attractive against other global and domestic brands. The bottom line: the short-term impact of tariffs depends on how competitive the market is and whether there are other options.

Over time, businesses can adjust by changing supply chains or shifting where products are made.

Different Industries, Different Outcomes

Not all companies are affected the same way. General Motors, for instance, reported that tariffs cost them $1.1 billion last quarter, cutting profit margins from 9% to 6.1%. But for Cleveland-Cliffs, a U.S.-based steelmaker, tariffs actually helped by limiting foreign competition and boosting earnings.

So, depending on the industry, tariffs can either be a burden or a benefit—and it may take a few more quarters to fully see the impact.

Trade Agreements Are Evolving

Several countries, including the EU and Japan, have secured better deals, lowering U.S. tariffs on their goods to 15%. Indonesia and the Philippines are seeing tariffs around 19%, while talks with China are still in progress.

This shifting landscape could continue to influence how companies perform and how markets react.

Markets Keep Breaking Records

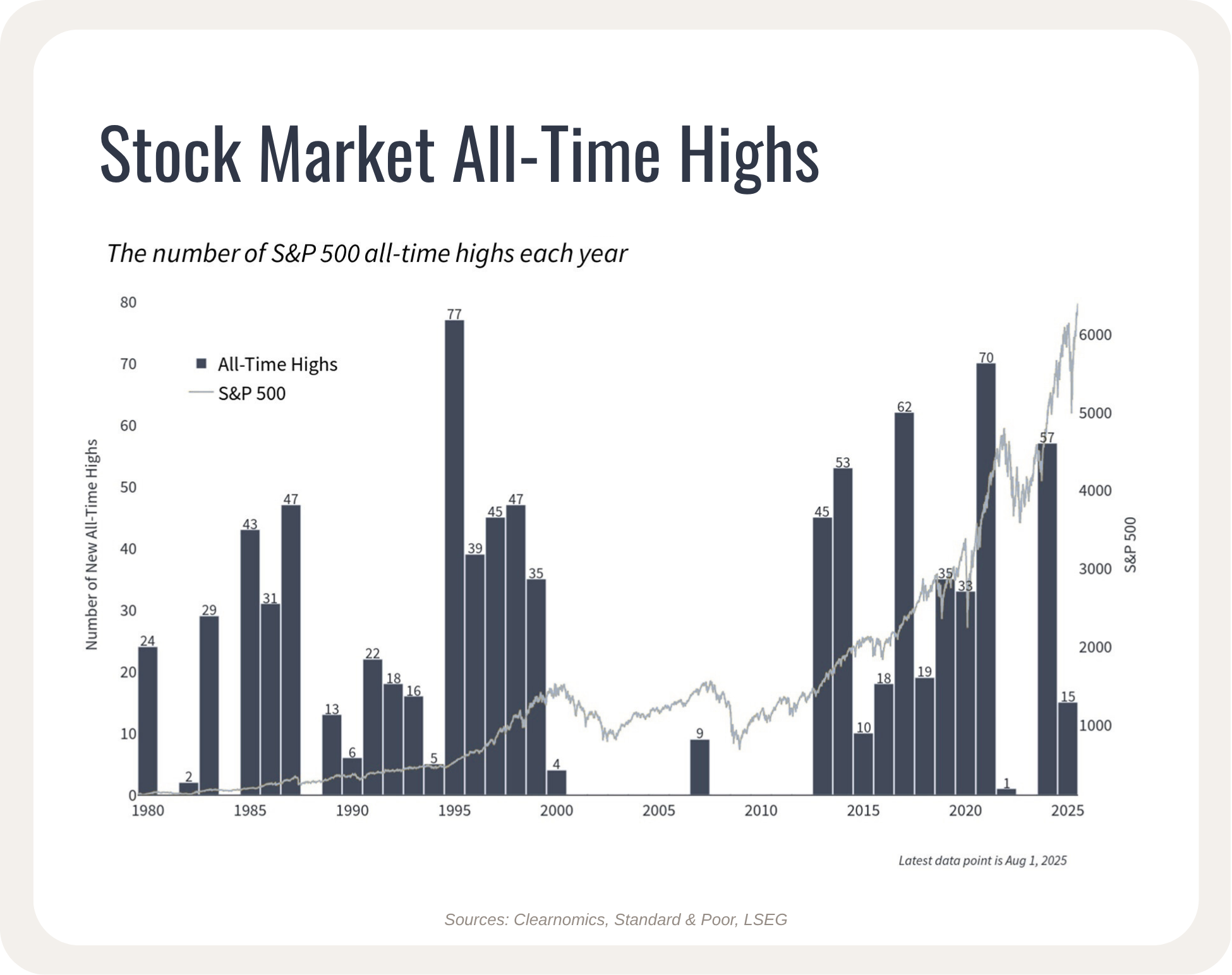

Despite trade uncertainties, markets continue to soar. The S&P 500 has notched over a dozen new highs this year—many just in the past month. The Nasdaq and Dow are also pushing record levels.

Yes, this makes some investors uneasy, but during economic expansions, markets often hit new highs again and again— and it’s important to know that it’s normal.

Still, tariffs are contributing to predictions of slightly higher inflation and slower growth in some forecasts. Companies that rely heavily on imports may see squeezed profits. But at the same time, these challenges often spark innovation, investment, and new efficiencies.

Predictability Matters More Than the Numbers

Even though tariffs are high, businesses care more about predictability. When trade rules are clear and stable, companies can adapt more effectively—shifting supply chains, planning costs, and managing risk.

Wall Street expects S&P 500 earnings to grow around 9.5% annually, with even faster growth in the next couple of years as trade settles down. Of course, forecasts are always subject to change, but the current outlook is optimistic.

Earnings Drive the Market

In the long run, the stock market tends to follow corporate earnings. When companies grow and earn more, their stock prices typically rise too. That’s why earnings are so important for investors.

Even if stock prices stay the same, rising earnings make the market more attractive. Currently, the S&P 500’s price-to-earnings ratio is 22.2x—above the historical average of 15.8x and approaching the 24.5x level we saw during the dot-com bubble.

So, it’s a time to stay aware but not panicked.

Tariffs are creating some headwinds, but strong earnings and improving trade conditions are keeping the economy and markets in good shape. While we’re likely to see continued ups and downs, staying focused on long-term goals and understanding how different factors impact the market is key to financial success.

Process over predictions.

Shean