🧭 Market Check-In: What’s Really Behind the Recent Dip?

Lately, investors have noticed an uptick in stocks hitting 52-week lows — a signal that can sometimes point to broader market weakness. But this time, there’s an interesting twist.

What the Data Shows

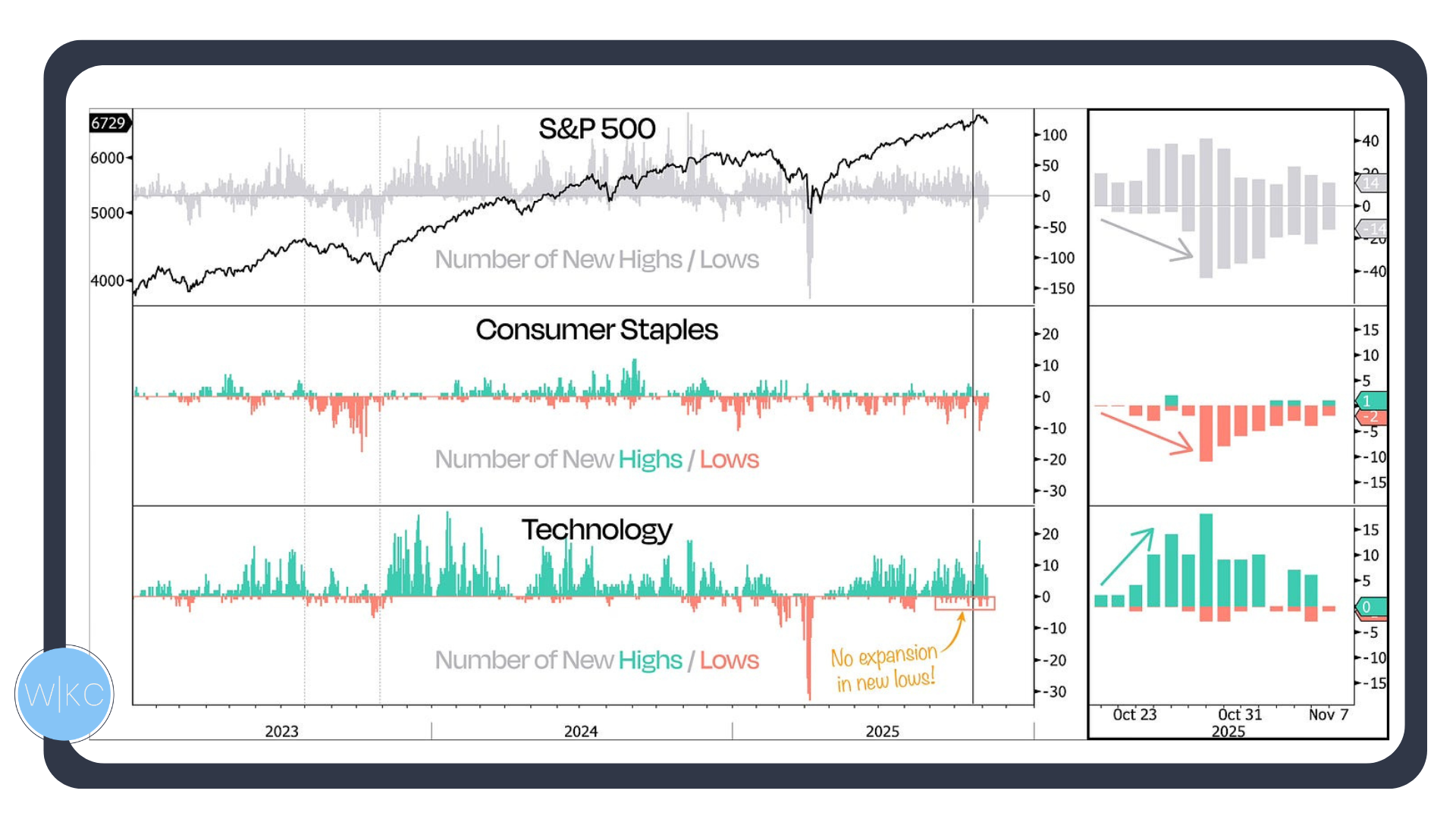

The chart above tracks new highs and lows across three groups:

S&P 500 (top panel) – The overall market benchmark.

Consumer Staples (middle panel) – Think household names like Procter & Gamble and Coca-Cola.

Technology (bottom panel) – The growth engines that include Apple, Microsoft, and semiconductors. These names make up the highest percentage of the S&P 500.

Recently, the number of new lows across the S&P 500 has increased. At first glance, that might look concerning — but when we dig deeper, we find that most of those lows are coming from defensive stocks, like those in Consumer Staples.

Meanwhile, Technology stocks are still producing more new highs than new lows.

Why That Matters

If new lows were expanding in growth sectors like Tech, that would suggest broader market weakness — a potential shift toward risk-off behavior. But that’s not what’s happening.

Instead, we’re seeing defensive sectors under pressure while growth and risk appetite remain stable. That combination often indicates a normal pullback, rather than a significant trend reversal.

Putting It in Context

This setup resembles the 10% dip we observed between August and October 2023. Back then, Consumer Staples also led the way in new lows, while Tech held steady. The market regrouped and moved higher afterward.

So far, no expansion in new lows across Tech is a positive sign. It shows that investors haven’t lost confidence in the parts of the market that typically lead recoveries.

This pullback looks healthy. The “defensive” names are wobbling, but risk appetite is still intact. If anything, this is a sign of a market rotation — not a breakdown.

We’ll keep an eye on whether new lows start spreading beyond Staples. As long as Tech continues to show strength, the odds favor this being a normal correction within an ongoing uptrend.

Process over predictions.

Shean