May Brought a Market Rebound Despite Ongoing Uncertainty

After a rocky April, markets bounced back pretty nicely in May.

The S&P 500 climbed out of the red for the year, helped by progress in trade talks and some solid economic data. That said, things are still pretty choppy—there’s a lot of mixed signals around inflation, interest rates, and government spending, which has investors a bit on edge. The economy seems to be holding up, but people are still cautious, especially with all the talk about government debt.

For long-term investors, May was a good reminder that markets can adjust—even when there’s a lot of uncertainty. After April’s dip, stocks steadied and fought their way back into positive territory. These kinds of rebounds happen more often than we think.

That said, we’re not done with volatility—expect more headlines about trade, debt, and the economy going forward.

What Moved the Markets

The S&P 500 was up 6.2% in May—its best month since 2023

The Dow rose 3.9%

The Nasdaq led the way with a 9.6% gain

Year-to-date:

S&P 500 is now up 0.5%

Dow is down 0.6%

Nasdaq is down 1.0%

Bonds slipped a bit—the Bloomberg U.S. Aggregate Bond Index was down 0.7%, but still up 2.4% for the year.

The 10-year Treasury finished May at 4.4%, showing people are still uncertain about federal spending.

International stocks did well too: Developed and emerging markets (MSCI EAFE and MSCI EM) both rose 4.0%.The U.S. dollar dropped to 99.3, close to a 3-year low.

Bitcoin hit an all-time high at $111,092 before cooling off to $104,834.

Gold also reached a new high at $3,422, ending May at $3,288—that’s a 24% gain so far this year.

Inflation cooled off a bit—April’s CPI showed a 2.3% year-over-year increase, the slowest since early 2021.

The economy added 177,000 jobs, and unemployment stayed at 4.2%.

U.S. Credit Rating Was Downgraded—But Markets Barely Flinched

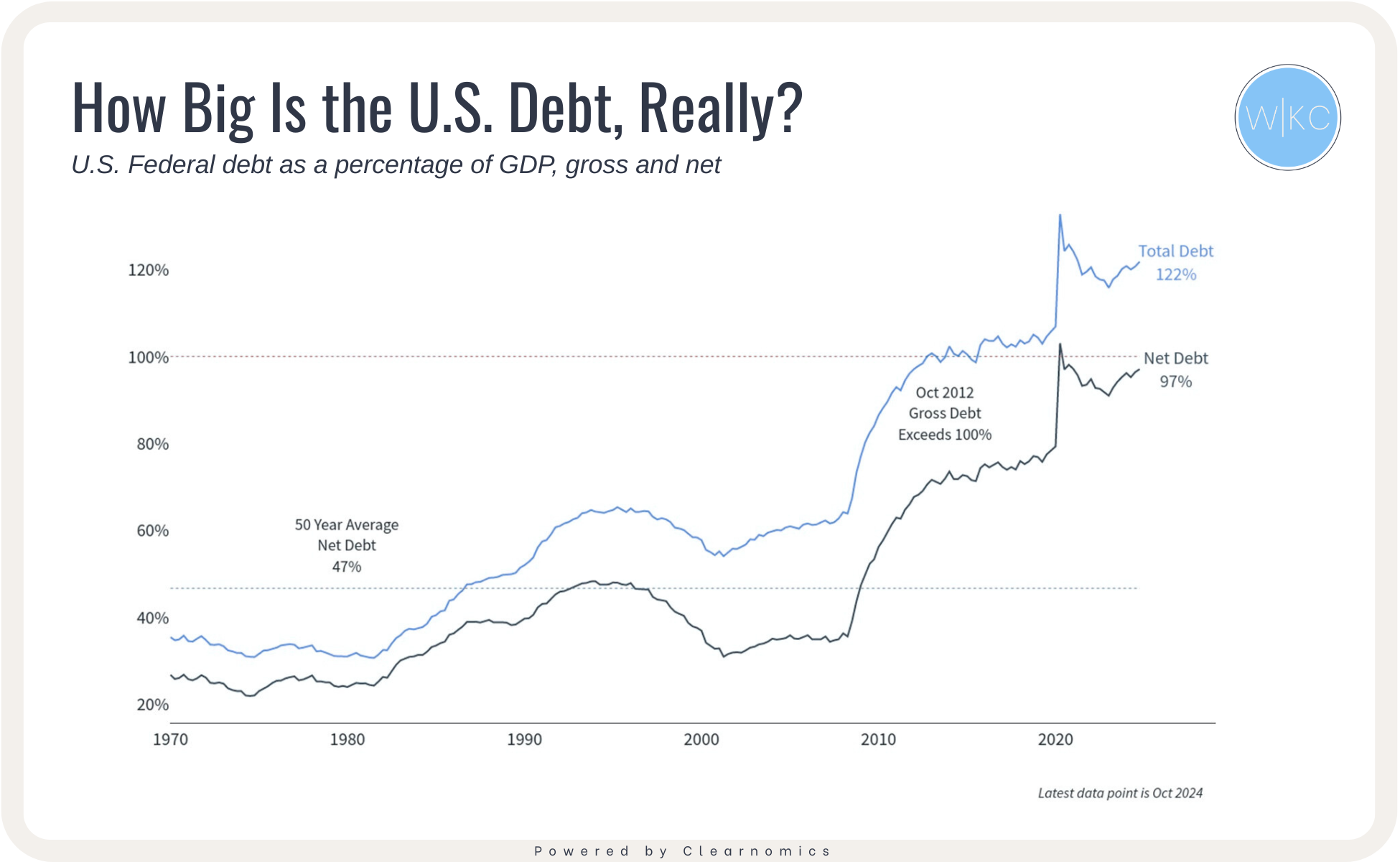

One headline that stood out in May: Moody’s downgraded the U.S. credit rating from Aaa to Aa1. Not a total shock—Fitch and S&P had already done it in past years. Basically, it’s about rising debt and spending. U.S. debt is now 122% of GDP (or 97% if you take out internal stuff).

But here’s the interesting part—markets didn’t really care. Treasurys are still seen as safe investments, and investors didn’t panic. If anything, it was more confirmation than surprise.

The downgrade came right after the House passed a big tax/spending bill—basically an update to the 2017 tax cuts. It’s expected to add around $2.8 trillion to the deficit over the next 10 years. Now it’s the Senate’s turn to weigh in.

Even with all that, the U.S. dollar and Treasurys remain top dogs globally.

Trade Deals Helped Lift Sentiment

Trade news played a big role in the rebound. The U.S. struck deals with both the U.K. and China, including a short-term pause on some tariffs with China. That gave markets a lift.

Of course, not everything is settled. Both countries accused each other of breaking the deal soon after, and talks about tariffs on things like steel are still going on. But there’s been some progress with the EU, and that helped, too.

A U.S. court also ruled that some tariffs may have overstepped presidential power—though that decision is on hold for now. Still, it adds to the uncertainty.

Corporate Earnings Were Strong

Q1 earnings were solid—most S&P 500 companies beat expectations, and 64% also reported better-than-expected revenue. Tech especially looked strong, despite all the other noise.

Consumers are still a bit cautious, but some data shows sentiment might be starting to improve. Inflation expectations are easing, and confidence is inching back up.

All in all, May was a solid month. Not perfect—but encouraging. Markets proved again that they can handle a lot and still find a way forward.

As always, focus on the process over predictions.

Shean