Planning for Rising Health Care Costs and the Role of HSAs

Health care is one of the biggest (and fastest-growing) expenses in retirement—and it's showing no signs of slowing down. According to recent estimates, a 65-year-old retiring today could spend around $165,000 on health care over their lifetime. For couples, that number can easily double.

With people living longer and needing more care as they age, building & budgeting health care costs into your retirement plan isn’t just smart—it’s essential.

There’s no one-size-fits-all solution, but there are several ways to prepare. Tools like tax-advantaged savings accounts, Medicare supplement policies, long-term care insurance, and retirement income strategies each play a role. The most effective plans often combine a few of these options to create a well-rounded approach that fits your specific health and financial picture.

One option that deserves more attention? The Health Savings Account (HSA).

Though they’ve been around since 2004, HSAs are still underused—and that’s a missed opportunity. For those with a high-deductible health plan, an HSA offers triple tax benefits and flexibility that’s hard to beat. It’s a smart way to lower your tax bill today and build a cushion for future medical expenses in retirement.

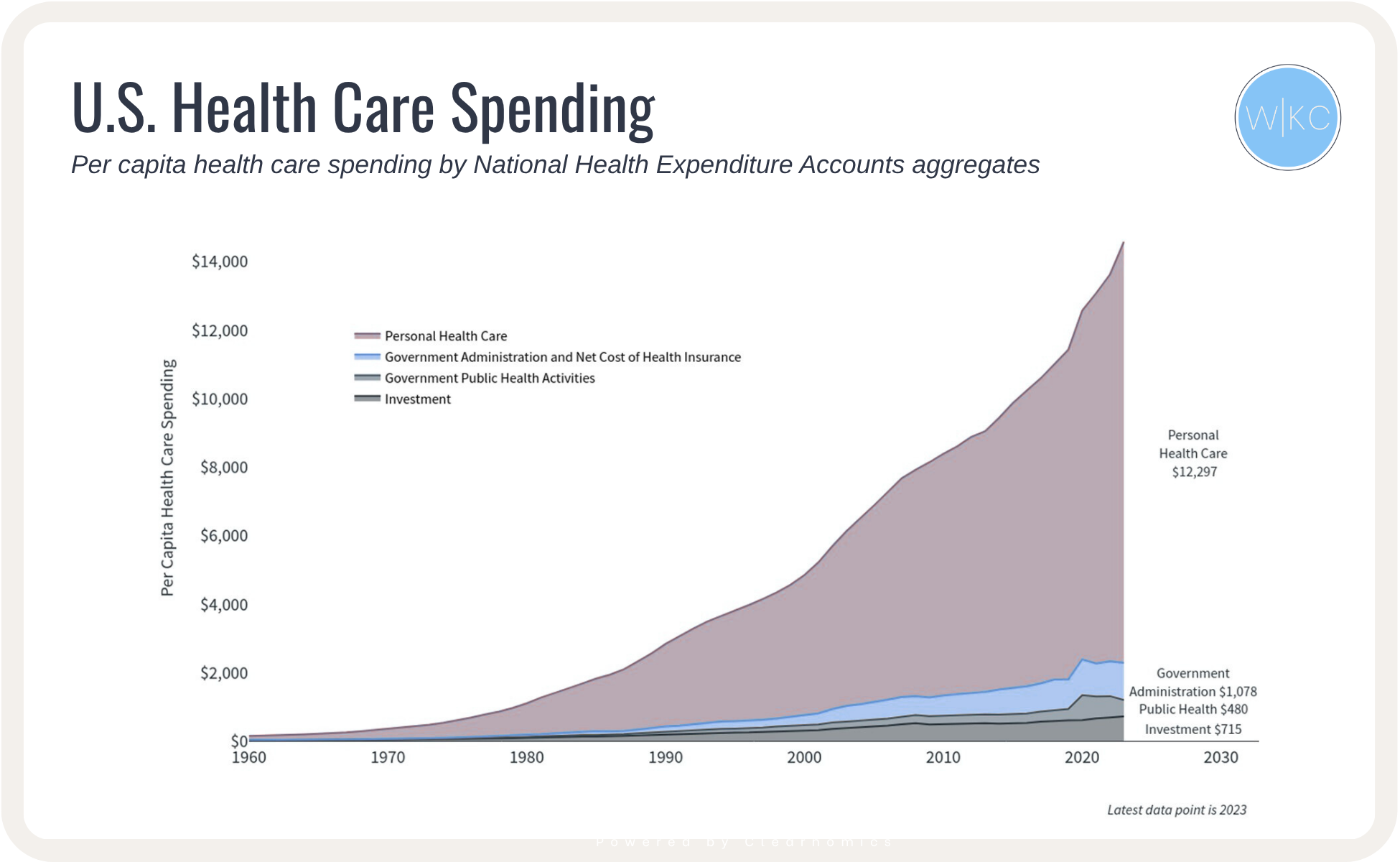

Health care costs continue to rise at an alarming rate

The growth in health care expenditures in the United States has been remarkable over the past several decades. In 2023, health care spending reached $4.9 trillion nationally – approximately $12,297 per person each year, and nearly 18% of GDP. This marks a dramatic increase from just 5% of GDP in 1962.

Healthcare costs are highest in retirement

Multiple factors drive this persistent growth, including an aging population, rising prevalence of chronic conditions, advances in medical technology, broader insurance coverage, and overall health care cost inflation.

So, what financial planning strategies are available? This should be considered across three areas:

Tax planning: Identifying strategies to fund health care expenses in a tax-advantaged manner, such as HSAs and Roth IRAs. Allowing your HSAs to grow and compound while you’re working, utilizing savings accounts to pay for healthcare cost while working, if possible.

Retirement planning: Understanding your future health care needs and determining the best funding vehicles, ensuring your plan has budgeted an adequate healthcare spending assumption built in. Again, HSAs can play an important role.

Estate planning: In the event you don’t utilize your health care allocation, assessing how different vehicles like HSAs will be treated becomes a worthy consideration.

HSAs offer tax advantages with growing contribution limits

For those who qualify, HSAs are a valuable financial planning tool. HSAs are available to individuals enrolled in high-deductible health plans (HDHPs), which in 2025 means plans with minimum deductibles of $1,650 for individuals or $3,300 for families. For 2026, these numbers increase to $1,700 for individuals and $3,400 for families.

What makes HSAs truly unique is their tax treatment. They are the only financial vehicle that offers triple tax advantages:

1. Tax-deductible contributions: Funds contributed to an HSA reduce your taxable income in the year of contribution, providing immediate tax savings.

2. Tax-free growth: Any interest, dividends, or capital gains earned within an HSA accumulate completely tax-free.

3. Tax-free withdrawals: When used for qualified medical expenses, withdrawals from HSAs are entirely tax-free, regardless of when they occur.

This combination of tax benefits makes HSAs financially more efficient to both traditional and Roth retirement accounts when the funds are used for qualifying health care expenses.

Contribution limits for HSAs have steadily increased over time. For 2025 the IRS allows contributions of up to $4,300 annually for individuals and $8,550 for family coverage. For 2026, the IRS allows contributions of up to $4,400 annually for individual coverage and $8,750 for family coverage, representing a 2.3% increase from the previous year. Individuals aged 55 and older can make an additional $1,000 in catch-up contributions annually. These contributions can come from you, your employer, or a combination, but cannot exceed the annual limits.

HSAs can transform retirement planning

With average life expectancies now extending well into the 80s for those over 65, the financial implications of extended retirement years have become increasingly significant, especially related to health care expenses.

One of the most advantageous HSA strategies – and one that many account holders overlook – is to treat your HSA as a specialized retirement account specifically for health care expenses. This approach involves maximizing annual HSA contributions while potentially paying some of your current medical expenses out-of-pocket. In this case, keeping receipts for qualified medical expenses you pay out-of-pocket is helpful, as these can be reimbursed from your HSA at any point in the future – even decades later – with no time limit.

Here’s the part many HSA users overlook: to truly unlock the power of an HSA, it needs to be invested for long-term growth—not just sitting in cash.

Most HSA providers offer a range of investment options, similar to what you’d find in a 401(k) or IRA. By putting your HSA funds to work in the market, you give them the chance to grow tax-free over time—building a dedicated, tax-advantaged bucket specifically for future health care costs in retirement.

Unlike traditional retirement accounts, HSAs don’t have required minimum distributions (RMDs) during your lifetime. That means your money can keep growing, untouched and tax-free, for as long as you want.

Even better? Once you turn 65, the rules become more flexible. You can use your HSA funds for anything—not just medical expenses—without paying that usual 20% penalty. You’ll still owe regular income tax on non-medical withdrawals, just like a traditional IRA, but that added flexibility can make a big difference in retirement planning.

HSAs can play a strategic role in estate planning

When we talk about financial planning, retirement is usually front and center—but estate planning deserves a seat at the table, too, especially when it comes to your HSA. What happens to your HSA after you pass away depends entirely on who you’ve named as your beneficiary.

Specifically, if your spouse is the named beneficiary, the HSA transfers to them with all tax advantages intact. They can continue to use the account as their own HSA, maintaining all the triple tax benefits.

For non-spouse beneficiaries such as children or other individuals, the treatment is less favorable and can create a significant tax burden, especially if the HSA is sizable. In some situations, it may be more tax-efficient to name your estate as the beneficiary.

These estate planning considerations highlight the importance of integrating your health care funding strategy within your broader financial plan, ideally with guidance from a qualified financial advisor who understands both the tax implications and your personal circumstances.

Rising health care costs aren’t going away, but HSAs offer a smart, tax-efficient way to plan ahead. If you’re eligible, don’t overlook this powerful tool when mapping out your long-term financial strategy!

Will