Debt, Deficits, and the Moody’s Downgrade and How It May Affect You

Moody’s just lowered the U.S. credit rating from Aaa to Aa1, officially ending the country’s run with top-tier debt status. This follows similar moves by Fitch last year and S&P back in 2011, and it reflects growing concern over the government’s long-term financial path. The timing isn’t random—Congress is in the middle of debating a new budget that could push deficits even higher. That’s raising red flags about the growing gap between tax cuts and responsible fiscal policy.

Understandably, this kind of news might leave you wondering how it could affect your financial plan.

Budget negotiations have historically created uncertainty

Over the past 15 years, we’ve seen our fair share of budget showdowns and debt ceiling drama—and markets have felt the impact. From the U.S. debt downgrade in 2011 to the fiscal cliff in 2013 and the government shutdowns of 2018–2019, these moments have caused real volatility.

But here’s what’s important: in every case, an agreement was eventually reached, and markets found their footing again.

Even after the 2011 downgrade—which was a big deal at the time—the S&P 500 bounced back within months. It might seem counterintuitive, but U.S. Treasury bonds are still seen as one of the safest places to be when things get shaky. They remain a key part of the financial system, even when headlines suggest otherwise.

It’s understandable to feel uneasy when the conversation turns to national debt and budget gridlock in Washington. As taxpayers and citizens, we want to see a sustainable path forward. But solutions aren’t simple, and despite various proposals and commissions, meaningful progress on reducing the deficit has been hard to come by.

Still, as investors, it’s crucial not to let these headlines knock us off course. Yes, fiscal debates and credit downgrades stir up uncertainty—but history shows us that markets have the resilience to recover. Staying focused on what we can control—like having a solid, long-term plan that includes diversification and disciplined investing—matters far more than trying to predict what Congress will (or won’t) do next.

Moody’s recent downgrade is a timely reminder of the bigger picture. While markets have responded positively in the past to pro-growth policies and potential extensions of the 2017 Tax Cuts and Jobs Act, Moody’s is pointing to real concerns. They highlighted that successive administrations haven’t been able to curb rising deficits or interest costs—and they don’t see much in the current proposals to change that trajectory.

In short, the fiscal outlook is complicated—but our investment approach doesn’t have to be.

TCJA provisions are on track to be extended or made permanent

Congress is deep in the weeds of crafting a new budget bill right now—and a lot of the details are still in flux. One of the big goals? Avoiding a “tax cliff” by extending the individual tax cuts from the Tax Cuts and Jobs Act (TCJA), which are set to expire at the end of 2025. Without an extension, we’d see a return to pre-TCJA tax rates, which could create real uncertainty for both households and businesses. Lawmakers are hoping that by tackling this early, they can offer a bit more stability.

The latest version of the tax proposal is pretty broad, with updates that would impact both individuals and business owners. Keep in mind—these details aren’t final, and they could still change. But here’s a snapshot of what’s currently on the table:

For Individuals:

TCJA tax rates would be made permanent, keeping the top rate at 37%.

Child tax credit would increase to $2,500 (up from $2,000), through 2028.

SALT deduction cap is being debated—with a proposed increase to $30,000 from the current $10,000 cap.

Tips and overtime pay would be exempt from income tax through 2028.

Interest on auto loans could become tax-deductible, also through 2028.

A new savings tool, “MAGA accounts” (Money Account for Growth and Advancement), would be introduced for kids under age 8 to help with future education, small business startups, or buying a first home.

For Businesses:

The pass-through business deduction would rise from 20% to 23%, and be made permanent.

100% bonus depreciation for qualified assets would return for property acquired between 2025 and 2029.

R&D tax deductions would come back.

Interestingly, some expected changes didn’t make it into the proposal—like a “millionaire tax” or adjustments to carried interest rules. On top of it all, the plan may include raising the debt ceiling by $4 trillion, which could add even more complexity to the fiscal landscape.

Deficits may continue to add to the debt

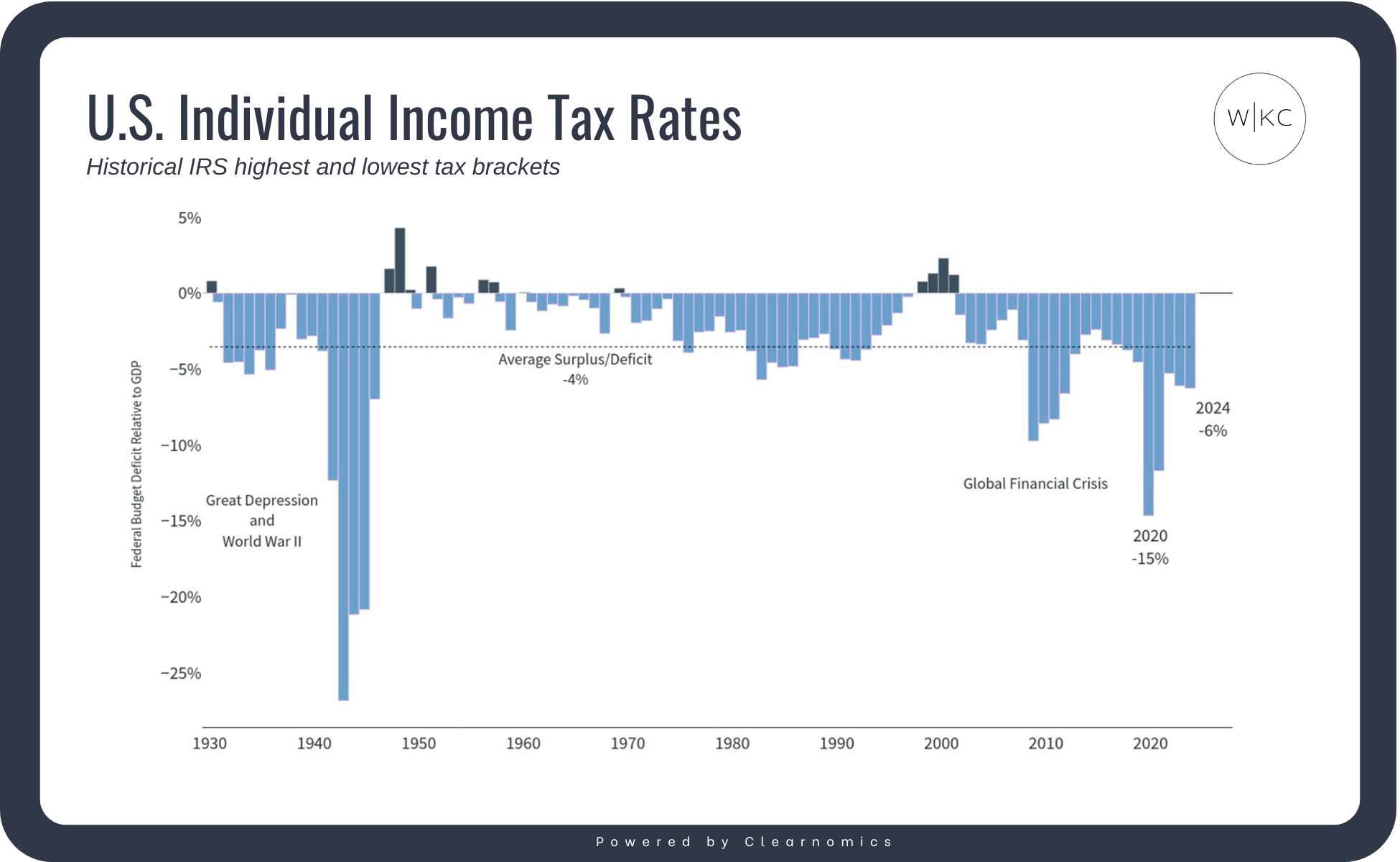

The latest budget proposal includes around $1.6 trillion in spending cuts—mostly from programs like Medicaid and nutrition assistance—but those are more than offset by new tax breaks and other spending.

Why does that matter?

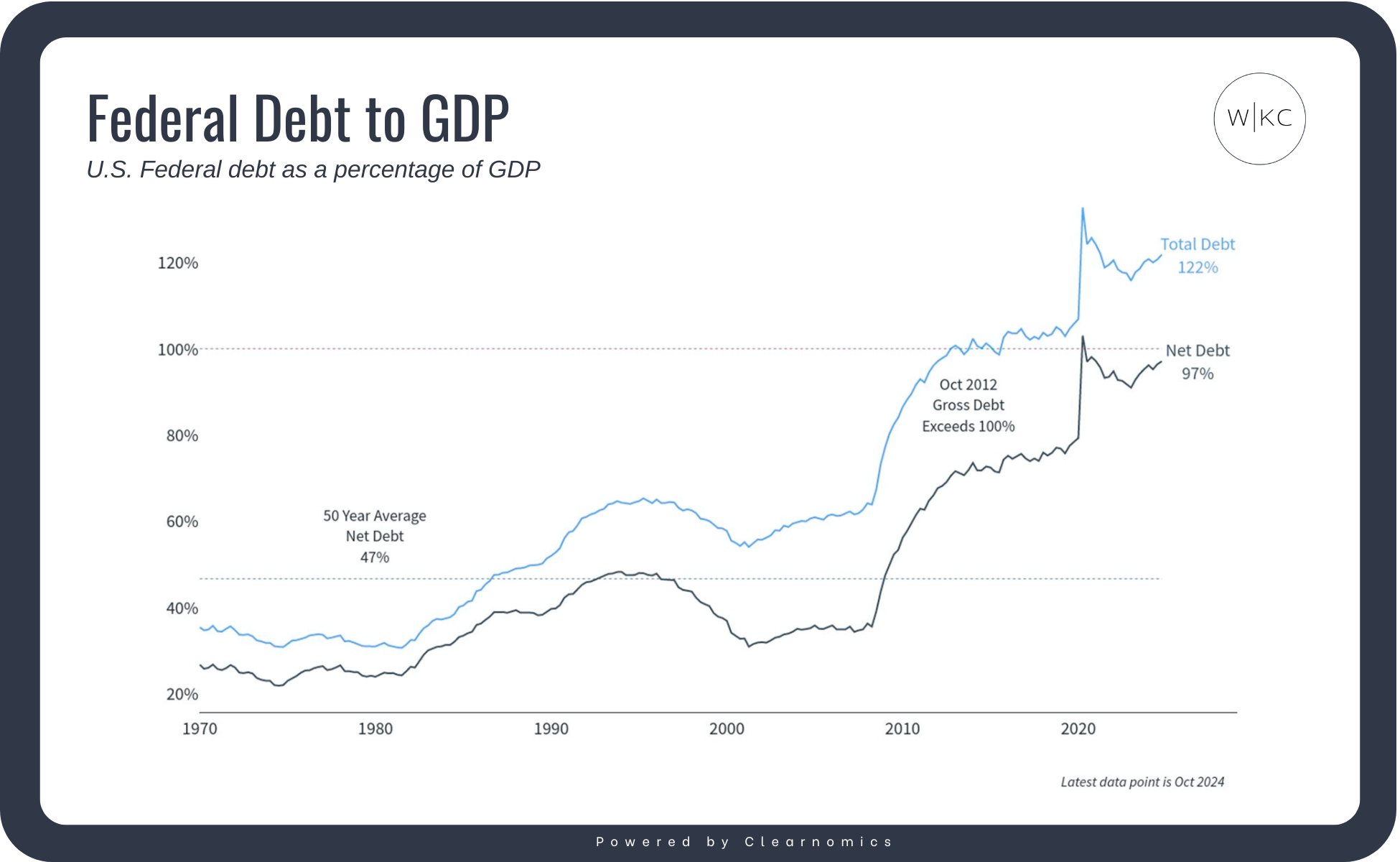

It adds to the national debt, which is already over $36 trillion—or about $106,000 per American. According to the nonpartisan Joint Committee on Taxation, the proposal could increase that by another $3 to $3.7 trillion over the next decade.

Debt and interest payments have been growing for years, and with most federal spending tied up in programs like Social Security and Medicare, cutting costs isn’t easy. That’s why some worry tax rates may eventually rise—even if parts of the Tax Cuts and Jobs Act are extended in the short term.

From an investment perspective, though, it’s important to stay grounded. Markets have done well across a wide range of debt levels, and some of the strongest rebounds came right after major deficits. Timing your portfolio around government spending trends hasn’t proven effective.

For most clients, from an investor standpoint, the direct impact is limited in the short term. The U.S. government remains extremely creditworthy, and Treasury bonds are still considered one of the safest investments in the world.

However, there are a few things to keep in mind:

Interest Rates: A downgrade can lead to slightly higher interest rates over time as investors demand more return for perceived risk. This may indirectly affect things like mortgage rates or corporate borrowing costs.

Market Volatility: These kinds of headlines can spook markets temporarily, but markets tend to absorb and move past them quickly if fundamentals remain solid.

Portfolio Impact: Your portfolio is already well-diversified and structured to weather both market events and economic changes like this. We’re monitoring developments closely, and no action is needed on your part right now.

If we start to see structural changes in bond yields or broader macro indicators, we’ll discuss how to adapt as needed.

Process > Predictions

Shean