Progress on Trade Brings Relief—and Opportunity—for Long-Term Investors

The U.S. and China announced a trade agreement that rolls back many of the tariffs that had shaken financial markets since April.

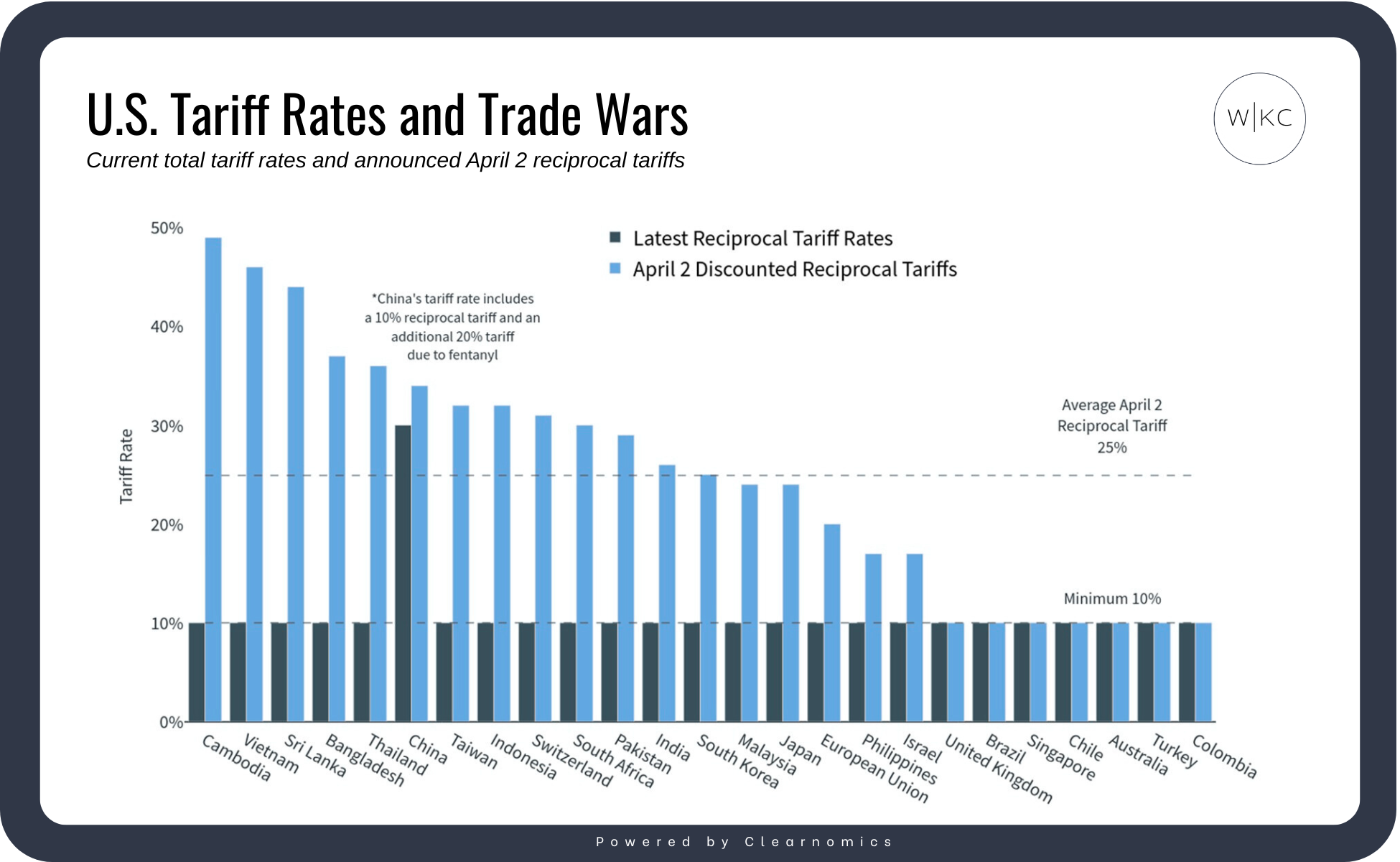

For the next 90 days, U.S. tariffs on Chinese goods will drop from 145% to 30%, and China will lower its tariffs on U.S. goods to 10%. On top of that, the U.S. is also pausing tariffs on some other countries and has reached a new trade deal with the U.K. All of this has given investors hope that a long, damaging trade war might now be avoided.

So, what does this mean for long-term investors?

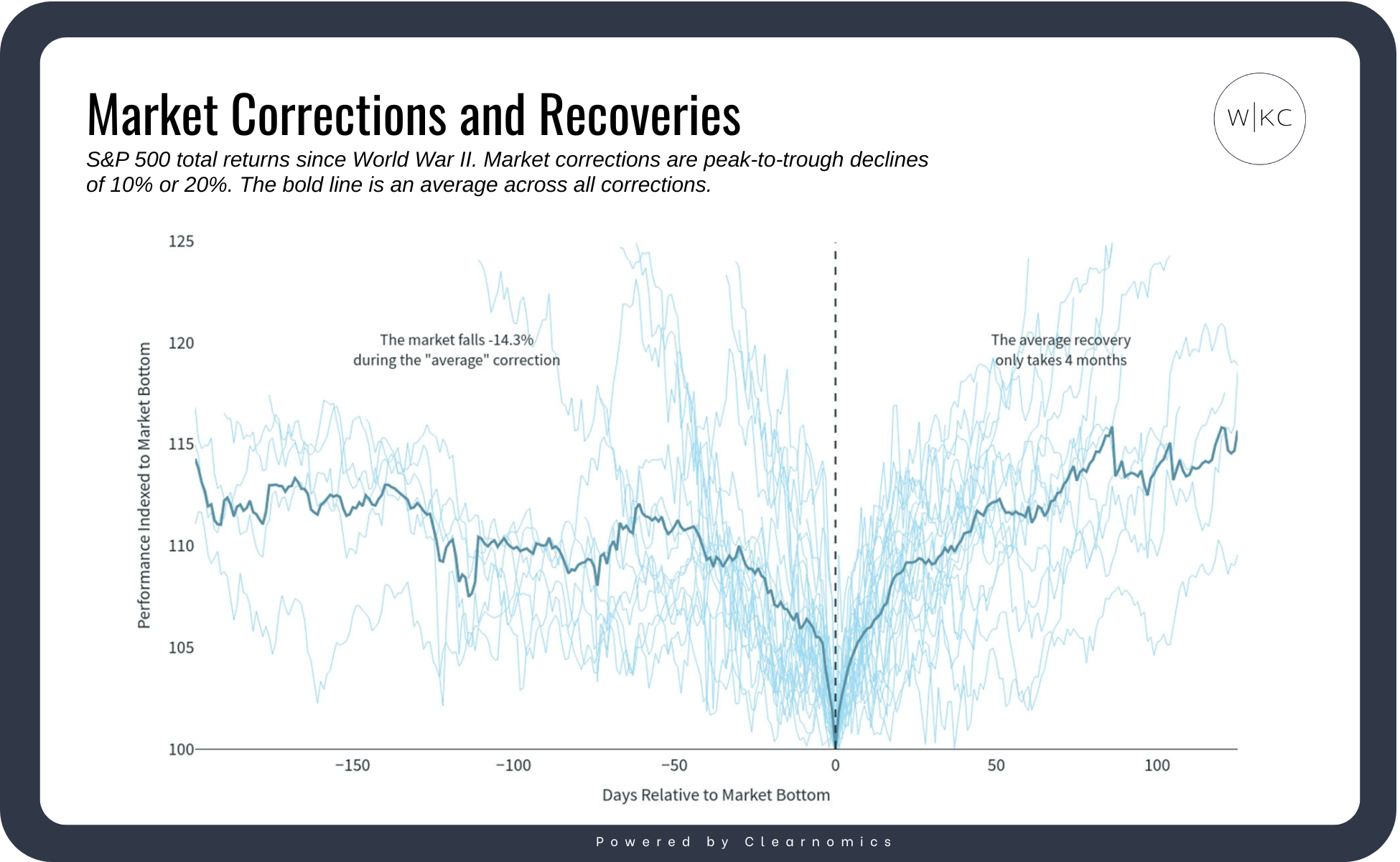

The stock market doesn’t like uncertainty or unpleasant surprises. When there's a sudden shock—like the big tariffs announced on April 2—markets often react quickly and negatively. But as more details come out and things become clearer, markets tend to bounce back.

That’s exactly what we’re seeing now. After a rough patch in April, the market has rebounded and is now slightly above where it was before the tariffs were announced. This follows a familiar pattern from past events: once the situation becomes clearer, recovery can happen quickly.

The U.S.-China accord is a positive sign for a broader deal

The new trade agreement between the U.S. and China is a positive step because it helps reduce some of the uncertainty that’s been making markets nervous. Under this deal, the U.S. will charge a 10% tariff on Chinese goods. However, it will still keep a separate 20% tariff in place that relates to the fentanyl crisis earlier this year. While things are still developing, this agreement is seen as a move in the right direction—it reduces tension and opens the door for a longer-term deal between the two biggest economies in the world. Even though tariffs are still higher than in the past, the chance of a worst-case scenario seems lower now.

Looking back, this situation reminds many investors of what happened in 2018 and 2019 during the first Trump administration. At that time, tariffs were also used as a negotiation tactic to push for better trade deals and reduce the U.S. trade gap with other countries. That approach eventually led to major agreements, like the “Phase One” deal with China and the USMCA (which replaced NAFTA).

These trade policies usually aim to accomplish a mix of things—like protecting U.S. manufacturing jobs, addressing intellectual property concerns, and managing immigration. What’s different this time is how aggressively the administration has used tariffs, surprising many experts and investors.

Still, there are signs that past patterns may repeat. The recent trade deal between the U.S. and the U.K. supports this idea. That agreement sets a 10% base tariff on goods from the U.K., allows up to 100,000 cars to be imported at that rate, and makes exceptions for steel and aluminum.

The economy has been resilient despite trade uncertainty

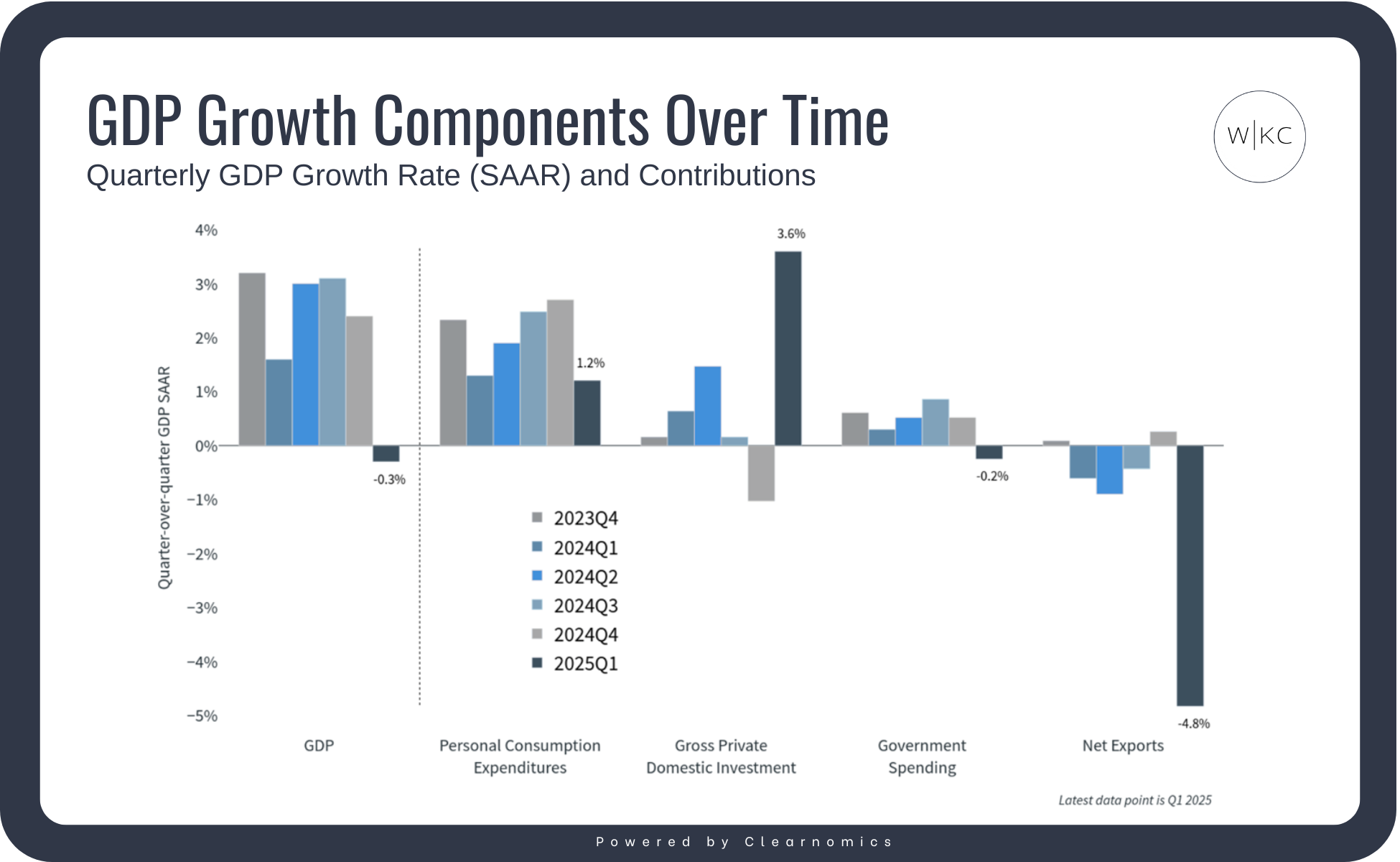

While the U.S. has made some progress with trade deals—especially with China—nothing is final yet. As a result, day-to-day news could still cause the markets to rise or fall, especially if current tariff breaks come to an end. Tariffs matter to investors because they can affect both inflation and economic growth.

For example, in the first quarter of the year, the U.S. economy shrank slightly because many companies rushed to buy goods before new tariffs kicked in. If trade policies become more predictable, it would help both consumers and businesses feel more confident.

Signs of Strength in the Economy

Even with all the uncertainty, some parts of the economy are still doing well. In April, the U.S. added 177,000 new jobs—better than expected. The unemployment rate stayed at 4.2%, a level it’s held since last May. A steady job market helps ease fears that tariffs could slow down consumer spending.

Inflation Is Cooling Off

Inflation is also slowly coming down toward the Federal Reserve’s goal of 2%. The most recent numbers show prices rising just 2.4% over the past year. A big reason for that is cheaper oil—prices are now at their lowest in four years. Lower oil prices mean lower costs for gas, shipping, and goods, which can help both consumers and the economy overall.

What About Interest Rates?

The new trade deal with China has also taken some pressure off the Federal Reserve to make immediate changes to interest rates. While markets still expect the Fed to cut rates later this year—maybe once or twice starting in July or September—there’s less urgency now. For the time being, the Fed is keeping rates steady and watching how the economy develops before making any big moves.

Market recoveries often occur when they’re least expected

Even though there are still risks in the market, the past few weeks have shown just how fast things can change. Markets tend to react strongly to bad news because they often assume the worst. When headlines are negative and the market drops, it’s easy to feel like things won’t get better. But while it’s smart to be aware of risks, that shouldn’t come at the cost of your long-term investment strategy.

This chart looks at how market pullbacks—called corrections—have played out since World War II. On average, the market falls about 14% during a correction, but it often recovers in just four months. What’s surprising is that these rebounds usually happen when people least expect them—like what we’ve seen recently after the U.S. and China made progress on trade talks.

When investors react too quickly to early signs of market ups and downs, they can end up off track—especially when it comes to long-term financial goals.

The most recent U.S.-China trade deal has helped ease fears about a possible recession and brought more clarity to the markets.

Process over predictions.

Shean